Ticker: TOTO.JK

Purchase Price: 232 Rp

Disclaimer: This report is for informational purposes only and does not constitute financial advice, endorsement, or recommendation of any investment strategy, security, or product. The author and publisher are not responsible for any investment decisions made based on the information provided in this report. Always consult with a financial advisor before making any investment decisions.

Executive Summary

Prologue: A Historical Pivot

TOTO Ltd., a renowned Japanese toilet company, marked a significant turning point in its history by establishing a joint venture with CV Surya, an Indonesian company, in July 1977. This collaboration led to the rebranding of CV Surya to PT Surya Toto Indonesia. Notably, this joint venture stands as a testament to TOTO's global expansion ambitions, as it represents the company's first business collaboration outside of Japan since World War II.

From an investment perspective, TOTO presents a compelling case:

Valuation Metrics: The company boasts a Price to Book Ratio of 1.03, indicating that it might be undervalued compared to its net asset value.

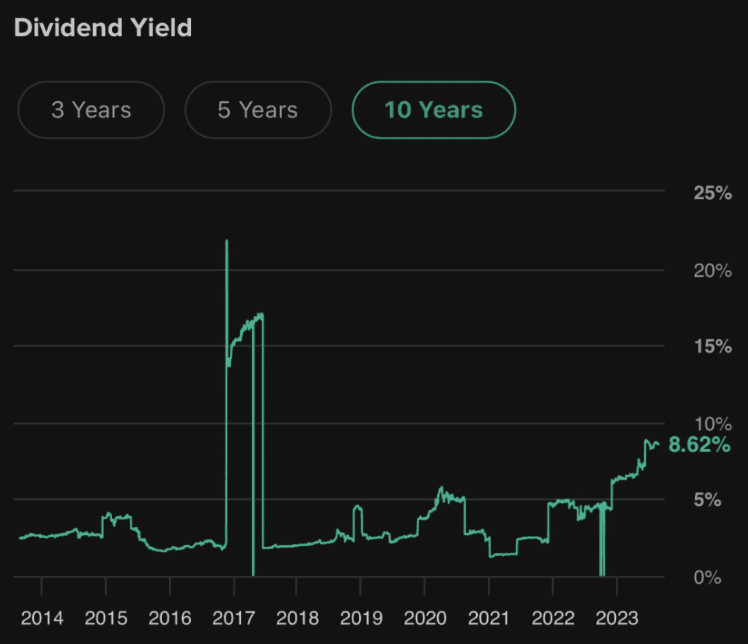

Dividend Yield: TOTO's annual dividend rate stands at an impressive 8.62%, making it an attractive option for income-seeking investors.

Profitability: The company's Current PE Ratio of 8.52 is favorable when compared to the industry average of 10.4, suggesting that TOTO is potentially undervalued relative to its earnings. Furthermore, TOTO's Net Profit Margin of 11.16% significantly outperforms the industry average of 6.08%, highlighting the company's superior operational efficiency and profitability.

In conclusion, TOTO Ltd.'s strategic joint ventures, combined with its strong financial metrics, position it as a potentially undervalued investment opportunity in the sanitation industry.

Company Overview

The Company was founded with the goal of manufacturing and selling sanitary, fitting, kitchen system and other related. Some of the products include:

Sanitary: Closet, lavatories, urinal, bidet etc.

Fitting: Faucet, shower etc.

Kitchen System: Kitchen system, wardrobe, vanity etc.

Accessories: Tissue holder, soap holder, towel hanger etc.

The TOTO Tale: From Japan to Indonesia

SPTO - Surya Pertiwi Tbk.: Founded in 1968, PT. Surya Pertiwi Tbk (SPTO) has been the exclusive agent in Indonesia for TOTO Japan, a leading Japanese manufacturer of bathroom products. TOTO is globally recognized as one of the largest bathroom product manufacturers, with its establishment dating back to 1917. In collaboration with TOTO Japan, SPTO's shareholders set up PT. Surya Toto Indonesia Tbk in 1977 to produce and market TOTO-branded items in Indonesia under TOTO Japan's license. Since 1978, SPTO has been the sole distributor of TOTO products in Indonesia, boasting an extensive distribution network that spans 14 major cities outside Greater Jakarta and Surabaya, covering the entire Indonesian archipelago. In addition to TOTO, SPTO also distributes other prestigious brands such as Villeroy & Boch, Stiebel Eltron, Geberit, Franke, Jacuzzi, and Kaldewei. The company's vision is to offer the most comprehensive selection of bathroom products and top-tier customer service.

Decoding the Numbers: Financial Insights

A closer look at TOTO's financial health and what the metrics reveal.

Price-to-Earnings (P/E) Ratio: 8.45

Analysis: With a P/E of 8.45, TOTO is trading at a discount compared to the industry average of 10.4. This suggests that the market may undervalue TOTO relative to its earnings potential. The forward P/E of 29.15 indicates that the market expects higher earnings growth for TOTO in the future. The company's technological and research edge (moat) could be driving this anticipated growth.

Price-to-Book (P/B) Ratio: 1.03

Definition: The P/B ratio compares a company's market capitalization to its book value. It indicates the inherent value of an asset based on its financials and market value.

Analysis: A P/B ratio close to one suggests that TOTO is trading near its book value. For value-oriented investors, a low P/B ratio can be attractive as it implies that they are paying close to the intrinsic value for the company's assets, providing a margin of safety.

Debt-to-Equity Ratio: 10.53%

Definition: This ratio measures the relative proportion of shareholders' equity and debt used to finance a company's assets.

Analysis: A lower debt-to-equity ratio indicates that TOTO relies less on external debts to finance its operations. This can be seen as a sign of financial stability, as the company is less vulnerable to economic downturns and interest rate hikes.

Current Ratio: 3.71

Definition: The current ratio is a liquidity ratio that measures a company's ability to cover its short-term obligations with its short-term assets.

Analysis: With a current ratio significantly higher than the industry average of 1.67, TOTO is in a strong position to meet its short-term liabilities using its short-term assets. This suggests good financial health and lower liquidity risk.

Return on Equity (ROE): 12.76%

Definition: ROE measures the profitability of a company in relation to shareholders' equity. It indicates how well a company is generating earnings from its equity.

Analysis: An ROE of 12.76% suggests that TOTO is effectively using its equity to generate profits. It's a measure of financial performance and indicates the efficiency of equity investment.

Return on Assets (ROA): 6.58%

Definition: ROA measures the profitability of a company in relation to its total assets. It indicates how efficiently a company is using its assets to generate earnings.

Analysis: An ROA of 6.58% indicates that for every dollar of assets, TOTO generates approximately 6.58 cents in profits. This showcases the company's ability to efficiently use its assets to produce profits.

Intrinsic Value Estimation

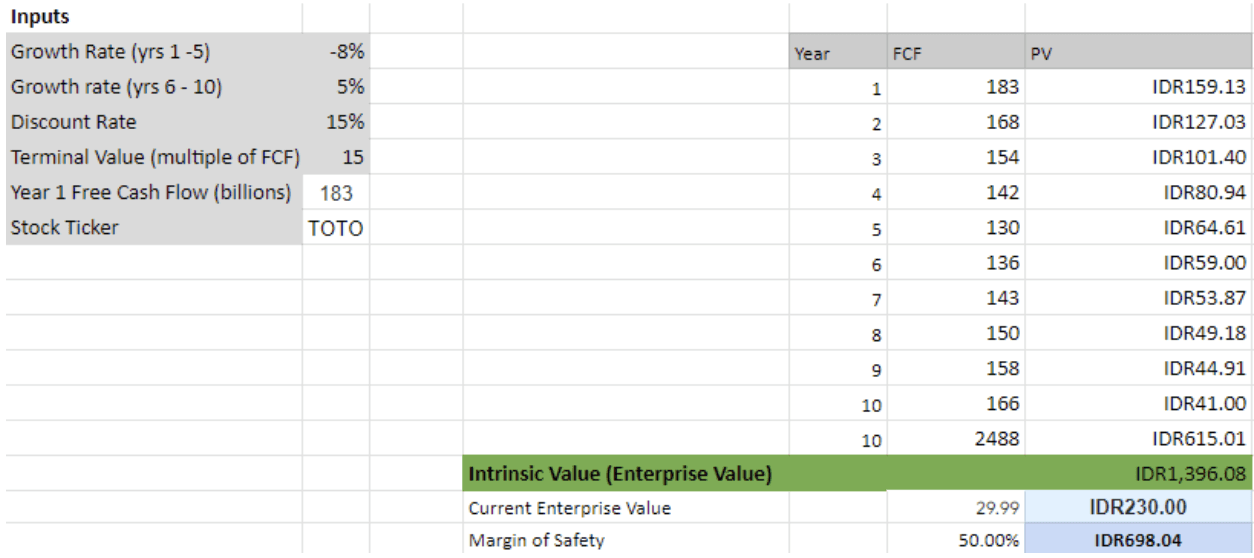

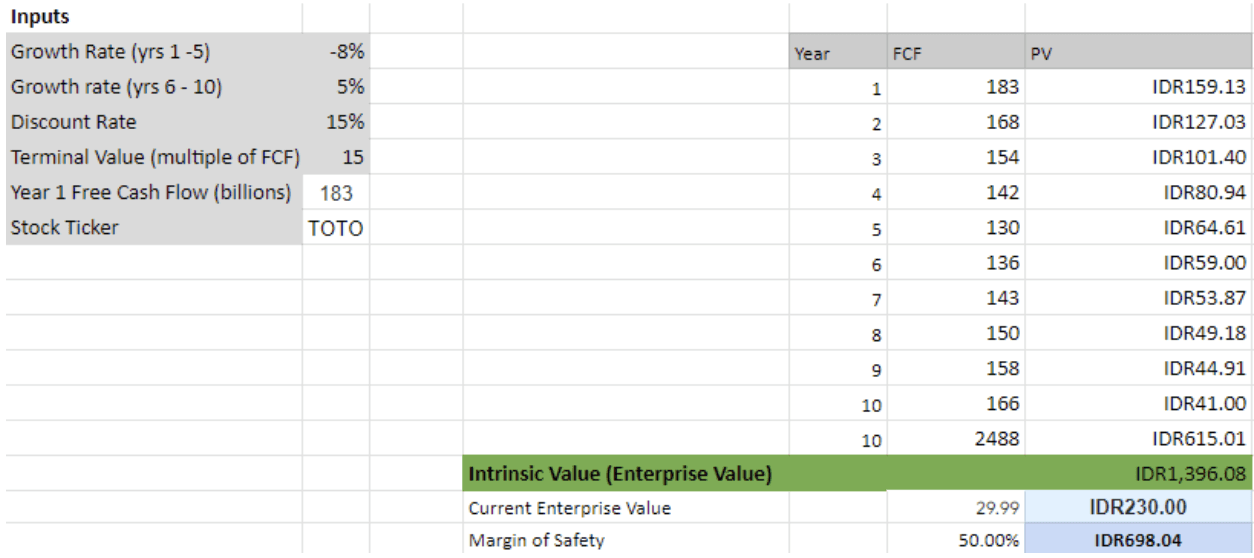

Most Likely Scenario

In this discounted cash flow (DCF) analysis for TOTO, the projections are designed to reflect a balanced, most likely scenario for the company's future trajectory. The growth rates are set at a cautious -8% for the first five years, indicating a period of potential contraction or challenges .Following the initial period, there's an anticipated moderate rebound with a 5% growth rate over the subsequent five years. This positive shift aligns with projections that see Indonesia rising to become the 7th largest economy globally. As a prominent player in the sanitary ware market, TOTO.JK is well-positioned to capitalize on this economic growth and further solidify its market presence (Mckinsey).

With a discount rate of 15%, the present values of the projected free cash flows are calculated for each year. The terminal value, representing the company's value beyond the tenth year, is determined using a multiple of the year 10 free cash flow. Summing up these present values yields an intrinsic enterprise value of IDR1,405.44.

When compared to the current enterprise value of IDR232.00, the analysis reveals a substantial upside potential. Even with a a margin of safety of 50%, the stock still offers significant value upside at its current price. This margin provides a cushion against potential errors in the estimation or unforeseen adverse developments.

Given this analysis, TOTO emerges as a compelling investment opportunity in the most likely scenario, warranting a 'BUY' recommendation. The company's valuation, even under moderate growth assumptions, suggests that it is undervalued and offers potential for significant returns to its shareholders.

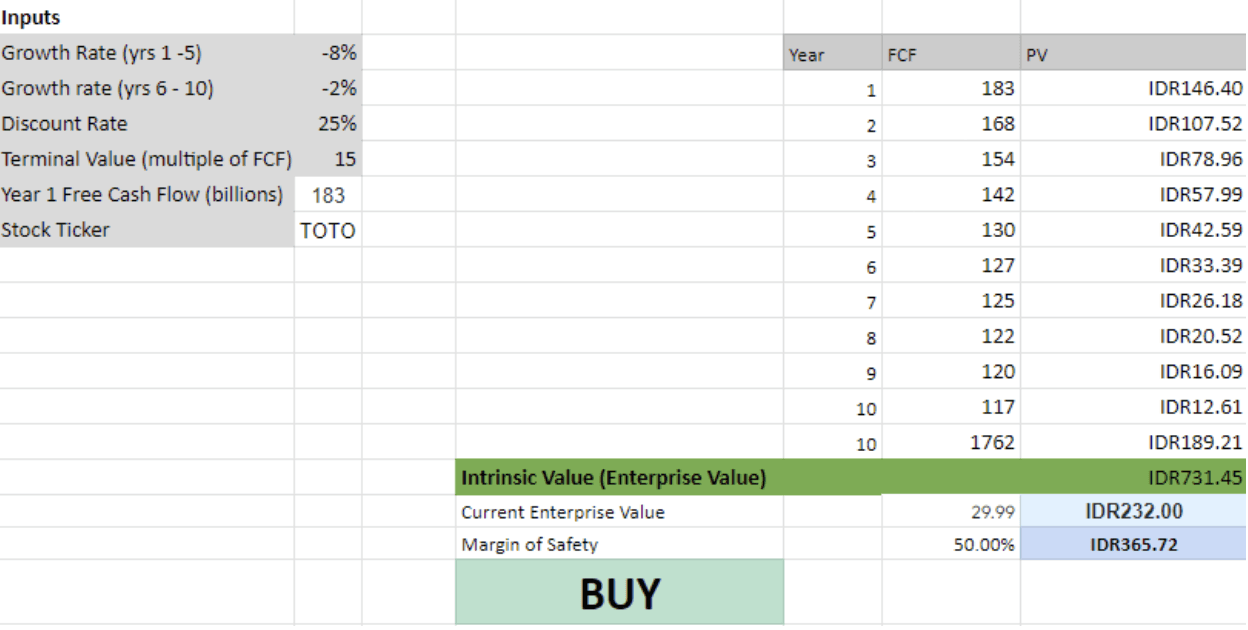

Worst Case Scenario

In the discounted cash flow (DCF) analysis for TOTO, a conservative approach was used. Recognizing the uncertainties inherent in forecasting, the growth rates for the first five years were set at a -8%, followed by a milder negative growth rate of -2% for the subsequent five years. This pessimistic projection serves to model a worst-case scenario for TOTO's future performance. Despite these conservative estimates, the intrinsic value derived from the DCF was significantly higher at 731Rp suggesting a substantial margin of safety. This analysis underscores the robustness of TOTO's valuation, indicating that even under adverse conditions, the company presents a compelling investment opportunity.

Best Case Scenario

In this optimistic discounted cash flow (DCF) analysis for TOTO, the projections reflect a highly favorable outlook for the company's future performance. The growth rates are set at an ambitious 13% taken from their current revenue YOY growth for the initial five years, tapering slightly to a still robust 10% for the subsequent five years. These growth rates capture the potential upside for TOTO, assuming the company capitalizes on favorable market conditions, innovation, and expansion opportunities. With a discount rate of 15% used in the analysis, the intrinsic enterprise value for TOTO.JK is determined to be IDR3,200.59 billion. This represents an upside of 1279% compared to its current enterprise value. TOTO emerges as a highly attractive investment, signaling a strong 'BUY' recommendation based on the company's potential to outperform and deliver exceptional value to its shareholders.

The Competitive Landscape: TOTO's Moat and Risks

What sets TOTO apart? And what challenges lie ahead?

Innovation and Brand Strength: TOTO's edge in the market.

Innovative Products: TOTO Ltd. is renowned for its innovative products, especially the Washlet series, which has gained immense popularity worldwide. The company's commitment to R&D has allowed it to introduce pioneering products in the market.

Global Presence: TOTO has a strong global presence with operations in Asia, Europe, and the Americas. This wide reach allows the company to cater to diverse customer needs and tap into various markets.

Sustainability Initiatives: TOTO is committed to environmental sustainability. The company's products, such as the water-saving toilet, reflect this commitment. TOTO's focus on eco-friendly products gives it an edge in markets where sustainability is a priority.

Quality Assurance: TOTO is known for its high-quality products, which are a result of stringent quality checks and a commitment to excellence. This reputation for quality has helped the company build trust among its customers.

Strong Brand Image: TOTO's brand is synonymous with luxury and sophistication in the sanitary ware industry. The company's consistent branding efforts have solidified its position as a premium brand.

Potential Headwinds: Challenges that could test TOTO's resilience.

Intense Competition: The sanitary ware industry is highly competitive, with several established players. TOTO faces stiff competition from both local and international brands.

Mature Phase: As TOTO is currently in the maturity phase there are potential risks that profitability and growth falls off over time.

Economic Fluctuations: The demand for luxury sanitary ware products can be affected by economic downturns. TOTO, being a premium brand, might face challenges in sales during economic recessions.

Dependence on Specific Markets: While TOTO has a global presence, it might be more dependent on specific markets for a significant portion of its revenue. Any downturn in these markets can impact the company's overall performance.

Supply Chain Disruptions: Global operations mean a complex supply chain. TOTO might face disruptions due to geopolitical issues, natural disasters, or other unforeseen events.

Dividend Deep Dive

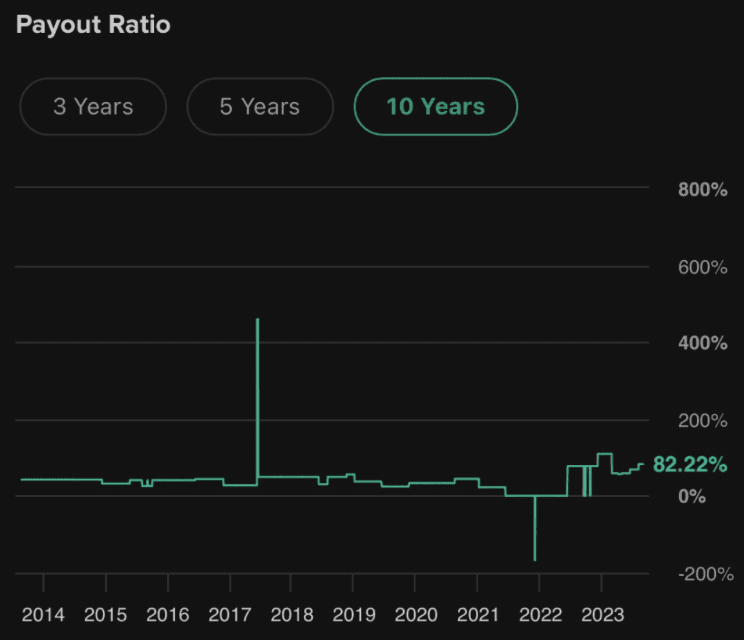

Payout Ratio: TOTO's payout ratio stands at 82%. A high payout ratio indicates that the company is returning a significant portion of its earnings back to its shareholders in the form of dividends. This is because TOTO is a mature company who are able to efficiently allocate their capital.

Dividend Streak: With an annual dividend streak of 15 years, TOTO has showcased consistent and reliable dividend payments. This long streak signifies the company's stable financial health, commitment to its shareholders, and its ability to generate consistent profits over the years.

Dividend Yield: The current dividend yield of 8.62% is notably high and one of the reasons I have added it into my portfolio. TOTO also has a continuously growing yield which suggests that the company is confident in its financial performance. This could be due to recovery from the pandemic

The Broader Canvas: Sanitary Ware Market in Indonesia

Price-to-Earnings (P/E) Ratio: 11.89

Price-to-Book (P/B) Ratio: 1.29

Current Ratio: 1.79

Return on Equity (ROE): 8.71%

Return on Assets (ROA): 5.02%

Sanitary Ware Market in Indonesia:

Market Overview: The sanitary ware market in Indonesia has been experiencing growth, driven by factors such as increasing urbanization, rising disposable income, and the growth of the real estate sector (Mordor).

Key Players: Some of the major players in the Indonesian sanitary ware market include TOTO, American Standard, Roca, Kohler, and Duravit.

Product Categories: The market is segmented into various product categories, including washbasins, water closets, cisterns, bathtubs, and others.

Distribution Channels: The products are distributed through multiple channels, such as retail, online, and direct sales.

Trends and Opportunities: The market is expected to witness significant growth opportunities, especially with the increasing demand for luxury sanitary ware products and the adoption of eco-friendly products.

Competitors

IMPC - Impack Pratama Industri Tbk.

Production of building material plastics

Production of PVC products

Production of fiberglass roofing

ARNA - Arwana Citramulia Tbk.

Production of green-certified ceramic tiles

Production of green-certified porcelain tiles

Production of green-certified granite tiles

HEXA - Hexindo Adiperkasa Tbk.

Distribution of heavy equipment and related spare parts

Mini, medium, and large excavators/loading shovels

Wheel loaders, rigid frame trucks, and articulated dump trucks

MLIA - Mulia Industrindo Tbk.

Trading company for products manufactured by its subsidiaries

Production of glass products such as float glass, glass container, glass block, and automotive safety glass

Ensuring products and services meet high standards adhering to various international certifications

AMFG - Asahimas Flat Glass Tbk.

Production of flat glass and automotive glass

Prioritizing safety, comfort, design, and environmental friendliness in their products

Emphasizing an extensive distribution network and long-standing business relations with its customers

MARK - Mark Dynamics Indonesia Tbk.

Manufacturing of hand formers or glove molds

Production of ceramic molds used to produce Nitril and Latex gloves for medical purposes

Production of agricultural products such as chemicals, pesticides, and modern farming equipment

SCCO - Supreme Cable Manufacturing & Commerce Tbk.

Specializing in the cable business for 50 years

One of Indonesia's largest and leading cable manufacturers

Offering international quality and reliability in their products

Epilogue: The Investment Verdict

TOTO Ltd. stands out as a beacon of innovation, financial robustness, and consistent shareholder value creation in the sanitary ware industry. Its strategic ventures, combined with its compelling financial metrics, paint a picture of a company that is not just surviving but thriving. The consistent dividend payouts further sweeten the deal for investors, making TOTO a compelling investment proposition. Given the analysis and the potential upside, myrecommendation is a strong 'BUY' for TOTO.