Research Question: Will Alphabet’s acquisition of Fitbit enable them to regain market leadership status?

By: Nathan Wongkar

November 2020

Word Count: 3992

Introduction

In 2007, Founders Eric Friedman and James Park established Fitbit Incorporated as a company aiming to provide well-being devices and services (Editorial). They sought to create wearable products that would transform the way people perceive fitness (“About Fitbit”). Initially, Fitbit was immensely successful as its products were revolutionary; however, they lacked behind competitors throughout the past few years. In 2020, Alphabet, Google’s parent company, had bought out Fitbit for $2.1 billion (Gartenberg, 2019). Alphabet acquired Fitbit at a premium of $7.5 per share and incorporated it into the parent company (Editorial, 2019). The motive of the acquisition was dependent on multiple factors that will be explored in this paper. This begs the question,

“Will Alphabet's acquisition of Fitbit enable them to regain market leadership status?”

This question plays a huge role in the wearables market as large companies like Apple and Samsung have long dominated the market; will Fitbit be able to compete with Alphabet’s aid? As we progress through the digital age, the use of technology has been integrated into our lives. It has become more critical day by day, especially with the recent COVID-19 outbreak; the importance of health will be very significant. The acquisition will support Fitbit’s management as their previous one may have been the cause of their considerable decline. With this acquisition, the experience from Alphabet will allow Fitbit to explore new opportunities.

By utilizing qualitative research and quantitative data such as past acquisitions, analyzing the current wearable industry, and determining the business’s intrinsic value, this paper will explore Fitbit’s acquisition by Alphabet.

Methodology

This paper will be supported by using a variety of resources, including websites such as Reuters, Bloomberg, The verge, and BBC News, with statistics coming from Statista and Fitbit’s 10k annual report. As Fitbit is a public limited company, they are obliged to create a yearly report by the SEC, which will be used as information for this paper. However, it may be biased as the annual report may be window dressed to attract investors. Tools and theories used in this Extended Essay are found in Paul Hoang’s 3rd edition Business Management and “The Intelligent Investor” by Benjamin Graham.

Discussion (Body)

Why did Alphabet choose to acquire Fitbit?

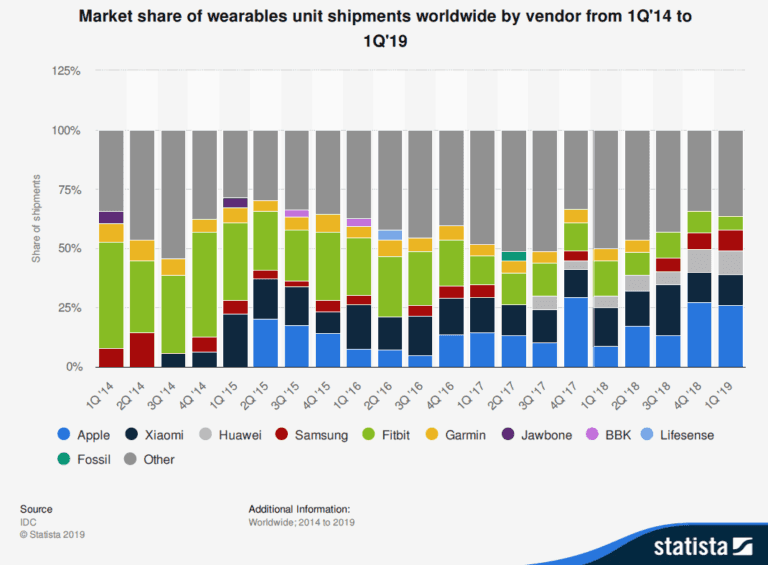

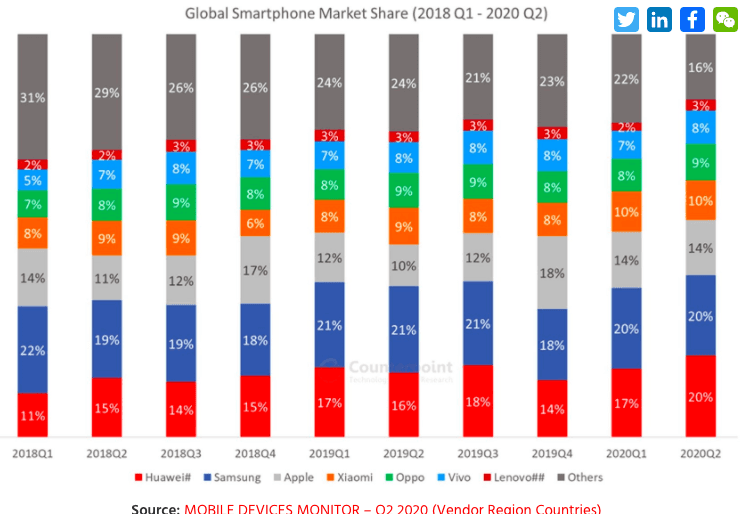

Throughout the past decade, Alphabet has acquired 240 companies (Reynold, 2016). These include Youtube, Motorola, Nest Labs, Android, and Waze (Reynold, 2016). Notably, some companies stand out due to the sheer magnitude of the acquisitions. The motive of the acquisition of Fitbit has been for multiple reasons; One of them being, Alphabet lacks the presence in the wearables industry (Statista). As competitors like Apple and Samsung have been dominating the sector, Alphabet may want to innovate and try to penetrate the wearables market as their market share only accounts for 7% in Q1’ 2019 compared to Apple’s 26% (Statista, 2020).

Figure 1 (Market share of wearables(Statista))

From this graph, it is also clear that Fitbit had the most market share in Q1 2014. Alphabet may have seen this as a benefit due to Fitbit’s brand image, which compelled them to acquire Fitbit.

Another reason that Fitbit is struggling is due to its weak management (Fitbit 10K, 2019); this is revealed through Fitbit’s stock prices. Hence, Alphabet saw a bargain and was able to acquire the company (Graham).

These factors have played a role in the acquisition of Fitbit. Although, a company as large as Alphabet, with a market capitalization of almost $1000 Billion, will have the experience and the proper resources to manage and improve Fitbit as a whole (Investing).

Perception Map

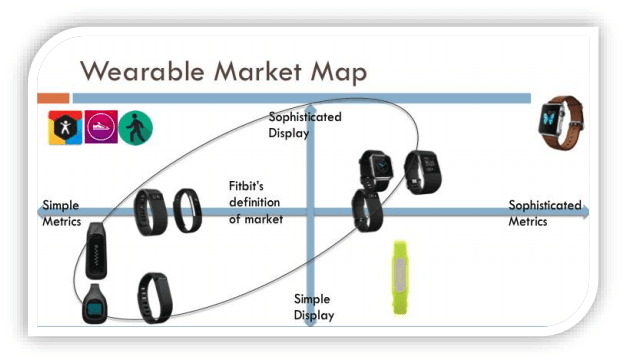

Presented below is a perception map of the smartwatch industry. A perception map may help determine the wearables market’s positions through a customer’s perspective (Hoang, pg 356).

Figure 2 (Perception Map of Wearables Industry (Dorbayani))

According to this perception map, Fitbit’s definition of their “market” are products with a good display or screen but have more simple metrics than other products such as the Apple Watch and the Samsung watches. However, from this perception map itself, it is revealed that the “market” and the type of products that Fitbit is selling are quite saturated.

Through the support of Alphabet, Fitbit could try and target the “Sophisticated Metrics” and a “Simple Display” market or, on the other hand, a product with “Simple Metrics” and a “Sophisticated Display.” Both these markets are quite empty; hence, an opportunity to try and gain market share there first. With Alphabet’s support, the company would design a product with these characteristics in mind, which may help Fitbit regain their market share.

Financial Analysis

The financial accounts of a business are crucial for assessing the operations of a specific company. In essence, it reveals a company’s performance, and stakeholders such as investors, managers, and competitors could utilize a company’s financial accounts to help make strategic business decisions (Hoang, pg 252). We will compare their relative performance towards the industry's standards and past performance from Fitbit’s financial reports. Financial analysis is also fundamental as it allows us to pinpoint the mistakes and improvements that Fitbit and Alphabet could make to help determine the certain parts they can improve in their business.

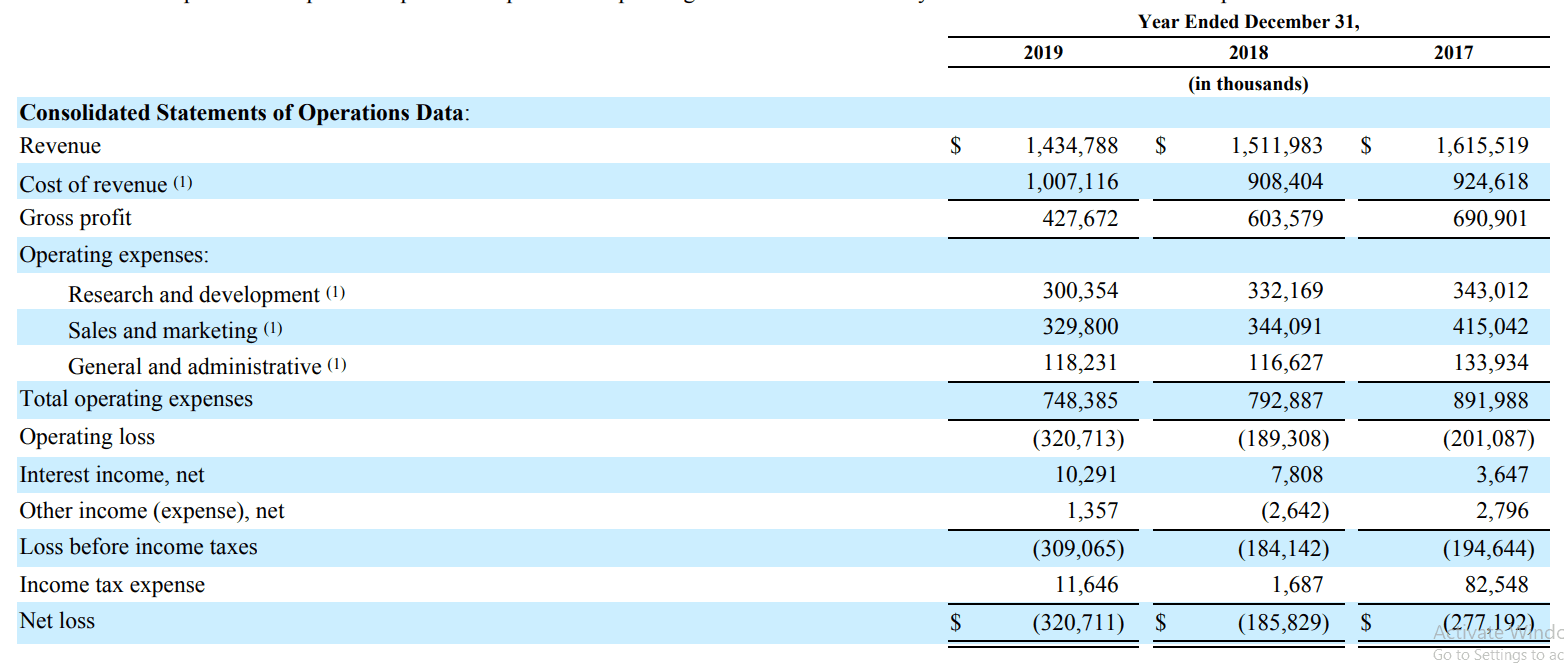

The Profit & Loss account

The Profit & Loss Account or the income statement publishes a company's trading activities during a specific period (Hoang). From Fitbit’s 10K annual report, they have shown this trading account.

Please refer to Appendix (1)

Further examining this, there is a constant decline in their revenue between the three-year period. It decreased by $103.5 million or 6.5% from 2017 to 2018, and $77.2 Million or 5% from 2018 to 2019. From examining the reports, three main factors are contributing to their constant decline in revenue. Firstly, Fitbit released their new budget smartwatch, the Fitbit Versa Lite, in 2019. This watch had low consumer receptivity to expected; hence, the decline in demand & overall sales. These may be due to competitors, such as Xiaomi and Huawei, who are selling much more affordable and better quality watches. Simultaneously, Fitbit has decided to increase discounts and promotions to survive in an intensely competitive market. Their businesses’ average selling price dropped approximately 17% from 105$ to 87$, leading to decreasing gross profit margins. On the other hand, in this case, their software products, “Fitbit Premium” a subscription-based app that allows Fitbit to create customized health plans, has increased 25% over the 2019 and 2018 period (Fitbit 10K Report).

Furthermore, its sales revenue decreased, and the company has been making a net loss over the past three years. The most significant decline was at the end of 2019, where they lost $320 million compared to the other years (Fitbit 10K Report).

A conclusion can be derived from the trading account, stating that the company is not profitable. However, we need to compare this to the industry's standards. According to Investing.com, if we compared Fitbit’s most recent quarter of earnings (January, February, March) and its earnings last year, we get a value -30.6%. The industry’s standard is 7.23%. This fact reveals that their competitors are increasing their sales, whereas Fitbit’s sales are decreasing. As seen through this analysis, the figures here could then be applied to help plan Fitbit’s future decisions & strategic planning.

Application of Financial Analysis

According to its annual report, Fitbit’s Health Solutions product has accounted for less than 10% of its sales. Its premium-based service accounted for less than 2% (Fitbit 10K). Through the analysis, the two companies would need to change the way they operate; Fitbit will not survive in such a competitive industry. Fitbit’s hardware and products lack the unique selling point to attract customers, shown through a constant sales decrease. Hence, Fitbit may need to target their watches’ software aspects to elevate that attractiveness to the watches. Their software aspects account for less than 15% of their revenue. Still, if Fitbit improves their software aspect with proper marketing, Fitbit will grow organically in a new market and capture that market share. Alphabet’s support would be much beneficial as they had experience in building special software such as Google the search engine. This is more applicable as in the current situation of the COVID-19 pandemic as the demand for health care has been forecasted to grow 28.5% from 2020 till 2060 (Digital Health). In the future, consumers would be more self-aware and reliant on technology to prevent cases and spreads of another disease. With Alphabet on Fitbit’s side, they are capable of using the economies of scale from the acquisition’s synergy to lower the costs of research and development of the new product. Fitbit can sell them to the customers at a competitive price but will allow them to keep their profit margins. When Fibit has gained enough growth in the software industry, they can expand back to the wearables industry and try to compete again.

Ratios

The profitability ratio is defined as the ratio that shows how well a business performed in financial terms (Hoang 273). With these ratios, Fitbit could be compared to other competitors to see how they are competing.

According to Investing.com, Fitbit’s gross margin of the 2019 operating year is 29.1%, and the industry’s average is 50.7% (Investing.com). Fossil, a competitor company that focuses mainly on smartwatches, has a gross margin of 49.6% which is almost double Fitbit’s, Even though both companies have a negative operating margin as well as a negative net profit margin; Fitbit at -7.75% net profit margin, and Fossil a -1.27%. In comparison, Apple has a net profit margin of 21.9%, followed by Samsung’s 13.44%.

Please refer to Appendix Figure (3)

We derived that Fitbit’s and Fossil’s fixed costs are too high, hence the negative operating margin. From investing.com, Fitbit’s operating margin is -26.9%, which is calculated by :

Operating profit - Sales revenue=Operating Margin

Alphabet and Fitbit need to lower it’s fixed costs. This is accomplished by reducing or changing their marketing techniques. According to Fitbit’s 10K report, they advertise using the following

“television and print magazines), sponsorships and public relations, digital marketing, channel marketing, endorsements by professional athletes and celebrities, POP displays, and allow our customers to interact and try on products.”

In 2019 Fitbit spent $260.2 Million on advertising; this figure is approximately 18% of its entire revenue (Fitbit 10K report).

Marketing CostsRevenue=260,000,000/1,434,788,000 × 100=18.14%

This figure emphasizes how Fitbit’s fixed costs are too high. Nonetheless, to fix this, Fitbit and Alphabet can work together to change their marketing tactics. With Alphabet’s experience in user data and advertising, Alphabet could help reduce costs for Fitbit as well as engage and attract many more customers.

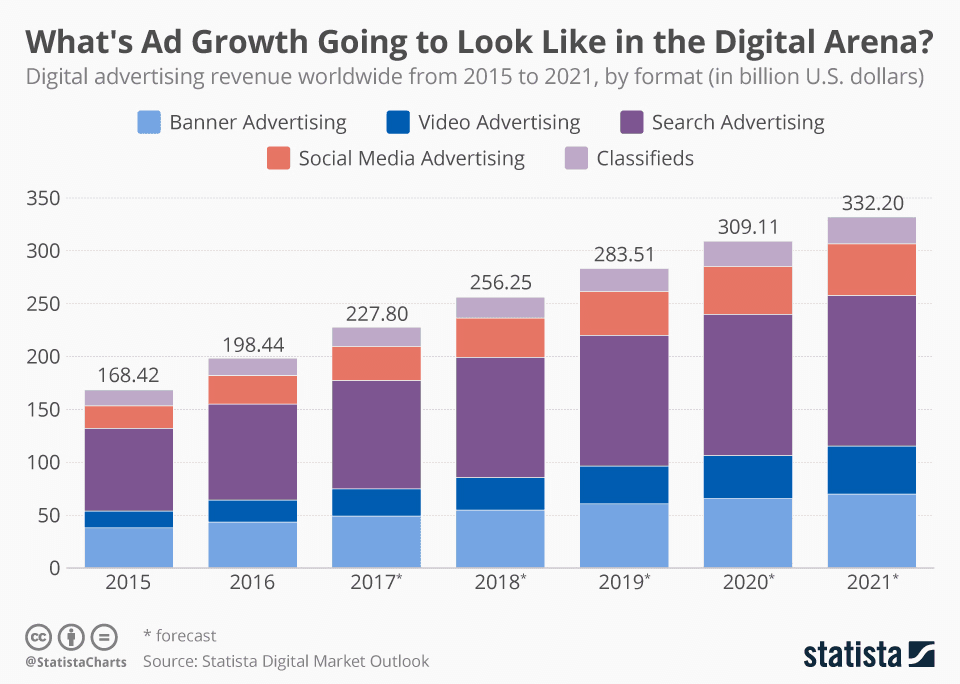

Figure 3 (What’s Ad Growth going to look like in the digital Arena (Statista))

According to this Statista graph, digital marketing is growing and is forecasted to grow 7.46% in 2021 (Statista). With Alphabet subsidiaries like Google, who is one of the largest digital marketers in the industry (Statista), Fitbit’s marketing would become more effective to gain customers. Fitbit may not have had an effective marketing strategy because their firm does not directly interact with customers, whereas Alphabet’s Google, focuses all of its resources in gaining and retaining these customers (Alphabet Investors Relations). Furthermore, since Alphabet would support them in marketing, Fitbit could utilize more resources on research and developing Fitbit’s new watches. This may provide Fitbit with a unique selling point or a better quality product that may help them succeed once again the wearables market.

Regardless, the information from these sources needs to be inspected. Firstly, the comparison between Fitbit and it’s competitors such as Apple and Samsung may not be the full picture as the net profit margin shown considers the broad product portfolio Apple has. It's not emphasized on the Apple Watch itself, similar to that of Samsung. Hence, a straight comparison with the two companies may not be fair. Moreover, from doing calculations using the official 10K report, Fitbit’s net profit margin is -22% for 2019. Investing.com uses “TTM,” which stands for Trailing Twelve Months, reveals that it has slightly improved in the past four months of 2020. Through this financial analysis, Fitbit’s weaknesses are be pinpointed, which could be used when analyzing the acquisition by Alphabet.

Alphabet’s previous acquisitions

One of Alphabet’s most significant acquisitions was Motorola for $12.5 Billion in the year 2011 (Reynold, 2020). However, Motorola did not succeed at all. During this period, Samsung has been using the Android operating system and adapting it to its own needs, leading to them “tainting” Alphabet’s image (Reynold, 2020). After acquiring the company, Alphabet & Samsung signed a patent deal not to use the android system. Alphabet then sold the company to Lenovo for $2.5 billion, a significant loss of approximately 10$ Billion.

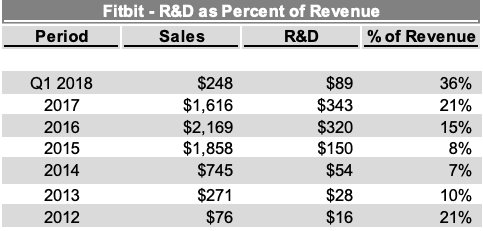

The experience that Alphabet has received from its past acquisitions will apply to answer the research question. When Alphabet acquired Fitbit, they were in a concentrated market with tons of competitors; these included Apple, Xiaomi, Samsung & Huawei (Statista, 2020). Apple is the market leader in the smartwatch industry, with around 37%, Xiaomi with about 18%, followed by approximately 10% in Samsung and Huawei and Fitbit with an approximate 5% market share 3Q 2019 (Statista, 2020). Furthermore, the company’s market share was significantly lower than the current market leaders, such as Apple and Samsung. A strategy that Alphabet can implement in Fitbit’s journey to regaining its market share would be reinvestments. According to Alphabet’s annual report, they invest more money into their smaller subsidiaries and in R & D as their expenses have increased from $21 Billion to $27 Billion in 2019 (Alphabet Investor Relations, 2019).

Figure 4 (Citron Research)

With Fitbit’s current rate of R&D Alphabet may be able to put some of that money into supporting Fitbit’s researching endeavours to hopefully be able to penetrate the “Sophisticated Metrics” and “Simple Display” market from the perception map analysis, as well as expand their product range so that it is not limited to just hardware.

As the CEO states

(Alpha Seeking)

An increase in funding into Fitbit may allow them to accomplish the goal that CEO James Park has established. This could be in the form of developing new products and improving Fitbit’s “Fitbit Premium” service which may benefit greatly from funding.

From the financial analysis, Fitbit could try and invest their money into new and more efficient marketing techniques as their marketing as of 2019 was approximately 18% of their revenue, which is a huge segment. With the increase in funding, they will be able to invest in new suppliers as of right now they only have one supplier. If it gets disrupted, the company may not be able to produce products, especially in this COVID-19 pandemic; another source of suppliers would be hugely beneficial for Fitbit in terms of their production (Fitbit 10K Report). With this, Fitbit will be able to grow organically as they would have more capital to invest, which can support them in regaining back their market share.

Tech Ecosystem

In September of 2019, Fitbit launched one of its best products for a while: the “Fitbit Versa 2”, which Techradar classified as affordable with better quality than previous generations (Peckham). The watch is priced at $150 on Amazon and is much more affordable than Apple’s & Samsung’s alternatives, such as the Apple Watch 5 and the Samsung Galaxy watches. One of the most compelling reasons why Fitbit is losing to Samsung and Apple is the ecosystem they have created through their other products, specifically their phones. According to Counterpoint Research, both in 2019 Q4, Samsung and Apple owns 18% of the smartphone market share, and Alphabet’s pixel phone has miniscule market share. (Team Counterpoint).

Figure 5 (Smartphone Market Share (Counterpointresearch)

An ecosystem creates brand loyalty towards these companies (Digital B.). With Alphabet’s pixel phone, the two companies can try to embed the Fitbit into that ecosystem. However, according to Statcounter, Alphabet only has a 2.37% market share in the smartphone industry ("Mobile Vendor Market Share North America | Statcounter Global Stats").

Likewise, the advantage of having an ecosystem is a double edged sword, as the Apple Watch is only practically usable in the Apple platform. Fitbit could utilize this opportunity and create an advantage by being a smartwatch that is diverse and usable on all platforms. This is especially beneficial as there are other companies they can target, such as Lenovo and Oppo, who have slowly started increasing their smartphone market share. Even though these companies have their own smartwatches, the customers will have Fitbit as a second option as the Android platform is not exclusive (Citron Research).

Furthermore, Alphabet can try to target the more affordable market, which means investing much more capital into the company to allow it to be more efficient and cheaper means of production. These investments could be in the form of lean production, a better manufacturer, bulk-buying materials and cheaper advertising. Which can help the company become more competitive in prices as Fitbit has lowered costs which means that they can lower their selling prices to compete in the more affordable market. This is much more beneficial than trying to embed the Fitbit watch into its ecosystem as Google’s pixel phone does not have enough market share in the smartphone industry to compete with others. In this manner, Fibit can try and shift their target audience towards the customers that want a smartwatch that is affordable and satisfactory in quality.

Healthcare Industry

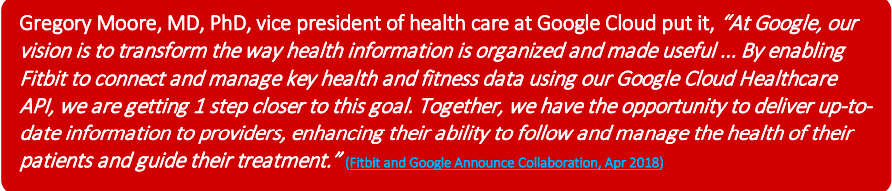

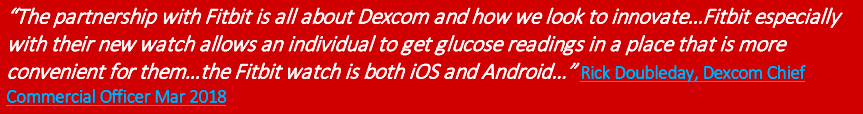

According to Gregory Moore,

With Fitbit’s Versa 2, a watch targeted for sports, Fibit can utilize this position as a means of separating themselves from the two giants. They can accomplish through the Unique selling point of enhanced health features that contrast them with other watches. They are already working on this with a partnership with Dexcom, another health related company.

With Alphabet’s support, Fibit can implement this paradigm innovation that could restore their former position as market leaders in the industry.

Previous Acquisitions

Fitbit’s acquisitions of Motorola was a major disaster. One of the significant contributors to the purchaser's failure was the fact that the company was already in turmoil (Hartung). According to this source from Forbes, the company “brings no leading market pieces - no game-changers.” (Hartung). Motorola’s most talented and top management and employees have also left to join rival firms. In 2011, Alphabet was a major software company that led to a hardware company’s management to be different (Hartung). Fitbit is a hardware company, but what makes it distinct in this instance, is that Fitbit still has potential to target other markets such as the healthcare industry and advancements in their hardware products as well. Additionally, Fitbit would have support from Alphabet’s extensive history with acquisitions and would yield them experience which then they apply in order to support Fitbit in regaining back their market share.

Application to Fitbit

Alphabet could make this external growth strategy work by implementing the correct teams that would adequately support Fitbit on its journey to regain its market share . An acquisition allows synergy, which Fitbit receives from the economies of scale Alphabet has, and, in addition to that, an already experienced company in the industry (Hoang). With Alphabet’s help and funding, the company can improve many aspects of their business, such as marketing, production, and product development. Right now, Fitbit has an operating margin of -26.9% according to financial analysis (Refer to Page 10). The support will improve Fitbit as a company as it would be more cost-efficient and effective. If Fitbit is more able to create efficient and cost effective products, they would be able to lower their production costs and increase their operating margins.With a decrease in their expenses, it would lead to better margins; hence, Fibit can lower the price to attract customers or invest in other aspects such as their research and development in their software.

STEEPLE Analysis

A STEEPLE analysis could pinpoint the external factors that will affect Fitbit’s operations (Hoang). A STEEPLE analysis here will be conducted to analyze the different factors that may impact Fitbits operations.

Firstly, technology plays an essential role in the operations of Fitbit. Advancements such as AI, smaller and more efficient components, processing power, and much more will allow Fitbit to innovate and create new products. The new technology would enable Fitbit to design and develop something completely different and create a niche that may help regain its market share (Upcoming Smartwatches). Additionally, Fitbit has open software that will allow the community of Fitbit users to implement customized applications that may attract new customers (Fitbit 10K). With proper usage of technology, Fitbit would be able to revolutionize the wearables industry, primarily if they target a niche like the software aspect. This would ultimately lead to Fitbit’s organic growth, which may support them in regaining back their market share.

Secondly, economic factors may influence Fitbit’s operations. With Alphabet’s support, they can survive during the economic downturn in the COVID-19 situation. However, Even with Alphabet’s aid, the company’s sales may be slowly reduced as consumers do not have the extra money to spend on luxury goods such as sports watches (Fitbit 10K). This may hinder Fitbit’s growth as the company may need additional funding to continue operating, hence the lack of resources that would be placed on growth and developing new products.

Not only economically, but politically, Fitbit would be heavily impacted, primarily as they operate in the US. The current trade war in the U.S with China has led to Fitbit losing out on critical suppliers (Fitbit 10K). The tariffs placed on the Chinese imported products will also lead to an increase in their selling price, which may reduce revenue as their products would be more expensive ("US-China Trade War In 300 Words"). Fitbit should try and find another supplier that does not come from China, which may allow it to have reduced costs. However, this needs time and waste resources, but it would be safer for them as the political situation with China will not benefit them. This will also influence their other competitors, such as Apple and Samsung. With Alphabet’s help, Fibit could turn this into an opportunity and get a supplier that is reliable to which they can exploit to be much more efficient.

From this STEEPLE analysis, Fitbit is more at a disadvantage in the light of these many factors. Most of the things included in this analysis are disadvantages for Fitbit, to which is an external factor that they cannot control. There are some opportunities in which Fitbit could take advantage over. This could include finding a new supplier, investing in R&D for technological advancements, and targeting the more affordable market especially during the pandemic where consumer spending has decreased.

Conclusion

As seen through this research, the research question was answered to a great extent.

As the acquisition is fairly recent, not much information has been released regarding how the two companies have been working together. With much more information such as new product releases, campaigns and reports, a better understanding and analysis of the acquisition could be formed. Hence, the information in this investigation is based on what the two companies have the ability to do.

As seen through the research, it can be said that Fitbit’s financials were weak and the company was constantly losing sales year on year. As a whole, the company is thoroughly struggling in terms of financial, operational and their marketing strategies. Through the analysis, the acquisition will benefit Fitbit greatly as Alphabet has the experience, reputation and the proper resources in order to aid in Fitbit’s growth. However, as shown through the market analysis, Fitbit’s position in the wearables market will not greatly improve as the competitors in the current industry are hard to compete with. This has led to the conclusion that instead of trying to improve their market position in the wearables industry, the Fitbit should instead try to compete in the healthcare software market. After Fitbit has gained enough market share and has innovated new products in the healthcare industry, they can try and compete for the market leader position as they will have an unique selling point in terms of their products as well as the proper resources.

Nevertheless, the two companies will be able to innovate and create new products that will greatly benefit the consumers. We should expect a new innovative product from these two companies that will revolutionize the way we use wearable technology in our daily lives. Alphabet has had some successful acquisitions before and as seen through this research, the companies will continue to grow even if it is not initially in the wearables industry.

The sources used for this investigation had the possibility to be biased. This is especially important regarding the 10K report, as the use of that document is to provide potential investors with information. Hence, the possibility of window dressing financial figures is possible which will weaken the investigation. The majority of the investigation is aided by academic & credible sources, thus ensuring validity.

Appendices

Appendix 1 Profit & Loss account of FITBIT (10-K Report)

Appendix 2

StrengthWeaknessOpportunityThreats- Open API in which the Fitbit community can contribute to. This means creating third-party apps that can help create a growing ecosystem that may attract new customers. (Fitbit 10K Report)- Most competitors have leveraged their sales through the use of a broader portfolio of products.

- Many of Fitbit’s competitors have had a long history of operating in the industry.

- Lack of brand recognition compared to competitors

- Rely on a limited number of suppliers. Some materials only from a single supplier

(Fitbit 10K Report)- The other companies’ watches are mainly accessories to their phones; there still could be improvements in the sportswear industry with other companies like Garmin lacking.

- With Alphabet’s acquisition, the amount of data they have could aid in the preferences of consumers which may help increase their sales

- Growing community in the software side.

- 44% of their sales are from the US. They may try and reach the international market (Fitbit 10K Report)- They are in a highly saturated industry, with competitors having lower costs and better quality products. (Fitbit 10K Report)

- Competitors have better resources and more efficient operations, which may lead to price cuts. This may lead to lower gross profit margins. (Fitbit 10K Report)

- lower demands in products and services shown through the lack of sales. (Investing.com)

- A decrease in growth in industry (Statista)

Appendix 3

FitbitIndustry AverageAppleSamsungGross Margin29.1%50.7%44.1837.26Net Profit Margin-7.75%8.02%21.9%13.44%

Bibliography (Work Cited)

Reports

“Alphabet Investor Relations.” Alphabet Investor Relations, 2020, https://abc.xyz/investor/.

Alpha, Seeking. "Fitbit's (FIT) CEO James Park On Q1 2018 Results - Earnings Call Transcript". Seeking Alpha, 2020, https://seekingalpha.com/article/4168924-fitbits-fit-ceo-james-park-on-q1-2018-results-earnings-call-transcript?part=single. Accessed 21 Sept 2020.

Citronresearch.Com, 2020, https://citronresearch.com/wp-content/uploads/2018/06/Fitbit-From-Fad-to-Future.pdf? Accessed 21 Sept 2020.

“Fitbit 10K Report". D18rn0p25nwr6d.Cloudfront.Net, 2020, http://d18rn0p25nwr6d.cloudfront.net/CIK-0001447599/64b8d60e-84e1-4cf8-8389-b3b96fe33608.pdf.

Websites

“About Fitbit.” Fitbit.Com, 2020, https://www.fitbit.com/us/about-us.

CNBC Television. “Here's Why Google Is Buying Fitbit, According To These Experts". CNBC Television, 2020. https://www.youtube.com/watch?v=sgAplQu_UFw

Chou, Jay. "IDC - Wearable Devices Market Share". IDC: The Premier Global Market Intelligence Company, 2020, https://www.idc.com/promo/wearablevendor.

Clement, J. "Search Engine Market Share Worldwide 2019 | Statista". Statista, 2020, https://www.statista.com/statistics/216573/worldwide-market-share-of-search-engines/.

Dieter Bohn, Nick Statt. "Google Nest: Why Google Finally Embraced Nest As Its Smart Home Brand". The Verge, 2020, https://www.theverge.com/2019/5/7/18530609/google-nest-smart-home-brand-merging-hub-max-rebrand-io-2019.

Digital, BBF. "BRAND ECOSYSTEM". BBF Digital, 2020, https://bbf.digital/brand-ecosystem. Accessed 21 Sept 2020.

"Digital Health Market Share Trends 2020-2026 Growth Report". Global Market Insights, Inc., 2020, https://www.gminsights.com/industry-analysis/digital-health-market. Accessed 25 Aug 2020.

Dorbayani, Mosi. "FITBIT MARKETING ANALYSIS & STRATEGY RECOMMENDATIONS". Docs.Wixstatic.Com, 2020, https://docs.wixstatic.com/ugd/9266cc_2c2372a01d1c4e31aa2b656681ed530f.pdf?index=true.

Doubleday, Rick. Rick Doubleday Outlines The Partnership Between Dexcom And Fitbit. Ajmctv, 2020. https://www.youtube.com/watch?time_continue=7&v=VusSZ-8WZkE

Editorial, Reuters. "FIT.N - Fitbit Inc Profile | Reuters". Reuters.Com, 2020, https://www.reuters.com/companies/FIT.N.

"Fitbit Premium". Fitbit.Com, 2020, https://www.fitbit.com/us/products/services/premium.

(FIT), Fitbit. "Fitbit Inc (FIT) Financial Ratios". Investing.Com, 2020, https://www.investing.com/equities/fitbit-inc-ratios.

Fitbit Launches Fitbit Care, A Powerful New Enterprise Health Platform For Wellness And Prevention And Disease Management". Investor.Fitbit.Com, 2020, https://investor.fitbit.com/press/press-releases/press-release-details/2018/fitbit-launches-fitbit-care-a-powerful-new-enterprise-health-platform-for-wellness-and-prevention-and-disease-management/default.aspx.

Garmin Revenue 2006-2019 | GRMN". Macrotrends.Net, 2020, https://www.macrotrends.net/stocks/charts/GRMN/garmin/revenue .

Gartenberg, Chaim. "Google Buys Fitbit For $2.1 Billion". The Verge, 2020, https://www.theverge.com/2019/11/1/20943318/google-fitbit-acquisition-fitness-tracker-announcement.

Gupta, Ruchi. "Google’S Nest Business Is Losing Key Customers—What's Next?". Market Realist, 2020, https://marketrealist.com/2019/10/googles-nest-business-is-losing-key-customers-whats-next/.

Hartung, Adam. "Google's Big Mistake - Buying Motorola To Save Android". Forbes, 2020, https://www.forbes.com/sites/adamhartung/2011/08/18/googles-big-mistake-buying-motorola-to-save-android/#41f53d765f26.

"Honest Review Of A Fitbit Charge 3". Community.Fitbit.Com, 2020, https://community.fitbit.com/t5/Charge-3/Honest-Review-of-a-FitBit-Charge-3/td-p/3032315.

Iqbal, Mansoor. "Youtube Revenue And Usage Statistics (2020)". Business Of Apps, 2020, https://www.businessofapps.com/data/youtube-statistics/.

Luckerson, Victor. "A Decade Ago, Google Bought Youtube — And It Was The Best Tech Deal Ever". The Ringer, 2020, https://www.theringer.com/2016/10/10/16042354/google-youtube-acquisition-10-years-tech-deals-69fdbe1c8a06.

Murphy, Mike. "Google Is Slowly Figuring Out How To Make Money Outside Of Advertising". Quartz, 2020, https://qz.com/1737518/google-cloud-pixels-and-nest-are-finally-making-a-difference/.

"Mobile Vendor Market Share North America | Statcounter Global Stats". Statcounter Global Stats, 2020, https://gs.statcounter.com/vendor-market-share/mobile/north-america.

Osterloh, Rick. "Nest To Join Forces With Google’S Hardware Team". Google, 2020, https://www.blog.google/inside-google/company-announcements/nest-join-forces-googles-hardware-team/.

Peckham, James. "Best Smartwatch 2020: The Top Wearables You Can Buy Today". Techradar, 2020,

Picardo, Elvis. "How M&A Can Affect A Company". Investopedia, 2020, https://www.investopedia.com/articles/investing/102914/how-merger-and-acquisitions-can-affect-company.asp. Accessed 9 Mar 2019.

Phaneuf, Alicia. "How Mhealth Apps Are Providing Solutions To The Healthcare Market's Problems". Business Insider, 2020, https://www.businessinsider.com/mhealth-apps-definition-examples?IR=T.

Porter, Jon. "Google Is Reportedly Trying To Buy Fitbit". The Verge, 2020, https://www.theverge.com/2019/10/28/20936415/google-fitbit-acquisition-alphabet.

Quora. "When A Company Is Acquired By Google, Do The Company's Employees Now Have To Go Through The Google Interview Process? Do The People Who Don't Pass The Interview Get Fired?". Quora, 2020, https://www.quora.com/When-a-company-is-acquired-by-Google-do-the-companys-employees-now-have-to-go-through-the-Google-interview-process-Do-the-people-who-dont-pass-the-interview-get-fired . Accessed 17 Feb 2020.

Research, GlobalData et al. "Top Tech Companies For Healthcare Wearables - Verdict Medical Devices". Verdict Medical Devices, 2020, https://www.medicaldevice-network.com/comment/top-tech-healthcare-wearables/.

Reynolds, Matt. "If You Can't Build It, Buy It: Google's Biggest Acquisitions Mapped". Wired.Co.Uk, 2020, https://www.wired.co.uk/article/google-acquisitions-data-visualisation-infoporn-waze-youtube-android.

Rogers, Adam. "A Look At Fitbit’S Research And Development Spending - Market Realist". Market Realist, 2020, https://marketrealist.com/2017/08/look-fitbits-research-development-spending/.

Rossignol, Joe."Apple Watch Continues To Dominate With Estimated 1 In 3 Share Of Smartwatch Sales Last Quarter". Macrumors.Com, 2020, https://www.macrumors.com/2019/05/02/apple-watch-1q19-market-share-counterpoint/.

Sawh, Michael. "5 Reasons Why Google Just Bought Fitbit". Techradar, 2020, https://www.techradar.com/news/5-likely-reasons-why-google-just-bought-fitbit.

Sarkar, Sharmishta. "Fitbit Versa 2 Review". Techradar, 2020, https://www.techradar.com/reviews/fitbit-versa-2-review.

Seabrook, John. "Streaming Dreams". The New Yorker, 2020, https://www.newyorker.com/magazine/2012/01/16/streaming-dreams.

Statista. "Wearables Market Share Companies 2014-2019 | Statista". Statista, 2020, https://www.statista.com/statistics/435944/quarterly-wearables-shipments-worldwide-market-share-by-vendor/.

Team Counterpoint "Global Smartphone Market Share: By Quarter - Counterpoint Research". Counterpoint Research, 2020, https://www.counterpointresearch.com/global-smartphone-share/.

"US-China Trade War In 300 Words". BBC News, 2020,"Upcoming Smartwatches 2020: Exciting Devices Still To Be Released". Wareable, 2020, https://www.wareable.com/smartwatches/upcoming-smartwatches-2020-7873. Accessed 6 Sept 2020.

Williams, Joseph. "Google-Fitbit Deal Advisers Look To Cash In, If Regulators Approve". Spglobal.Com, 2020, https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/55549383.

Williams, Owen. "The Wearable Fitness Market Is Now Just Apple And Google". Medium, 2020, https://onezero.medium.com/the-wearable-fitness-market-is-now-just-apple-and-google-d50ff9f67aa6.

“Worldwide Wearables Shipments Surge 94.6% In 3Q 2019 Led By Expanding Hearables Market, Says IDC". IDC: The Premier Global Market Intelligence Company, 2020, https://www.idc.com/getdoc.jsp?containerId=prUS45712619.

Books

Graham, Benjamin. The Intelligent Investor. 5th ed., Harpercollins, 2009.

Hoang, Paul. Business Management (3Rd Edition) Paul Hoang - IB Textbook International Baccalaureate. 3rd ed., IBID Press, 2014.

Fisher, Phillip. Common Stocks And Uncommon Profits. 1st ed., Willy Investment Classics, 1957.