Ticker: TOTO.JK

Purchase Price: 232 Rp

Disclaimer: This report is for informational purposes only and does not constitute financial advice, endorsement, or recommendation of any investment strategy, security, or product. The author and publisher are not responsible for any investment decisions made based on the information provided in this report. Always consult with a financial advisor before making any investment decisions.

Executive Summary

Prologue: A Historical Pivot

TOTO Ltd., a renowned Japanese toilet company, marked a significant turning point in its history by establishing a joint venture with CV Surya, an Indonesian company, in July 1977. This collaboration led to the rebranding of CV Surya to PT Surya Toto Indonesia. Notably, this joint venture stands as a testament to TOTO's global expansion ambitions, as it represents the company's first business collaboration outside of Japan since World War II.

From an investment perspective, TOTO presents a compelling case:

Valuation Metrics: The company boasts a Price to Book Ratio of 1.03, indicating that it might be undervalued compared to its net asset value.

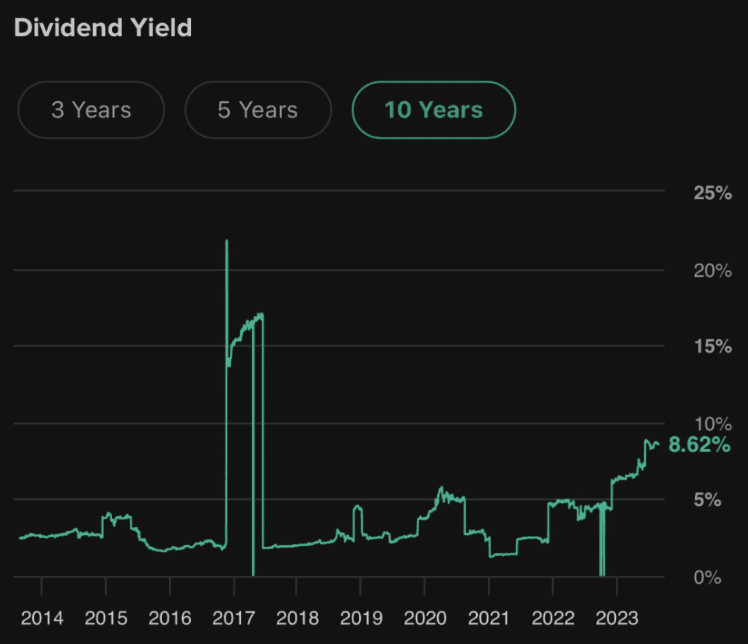

Dividend Yield: TOTO's annual dividend rate stands at an impressive 8.62%, making it an attractive option for income-seeking investors.

Profitability: The company's Current PE Ratio of 8.52 is favorable when compared to the industry average of 10.4, suggesting that TOTO is potentially undervalued relative to its earnings. Furthermore, TOTO's Net Profit Margin of 11.16% significantly outperforms the industry average of 6.08%, highlighting the company's superior operational efficiency and profitability.

In conclusion, TOTO Ltd.'s strategic joint ventures, combined with its strong financial metrics, position it as a potentially undervalued investment opportunity in the sanitation industry.

Company Overview

The Company was founded with the goal of manufacturing and selling sanitary, fitting, kitchen system and other related. Some of the products include:

Sanitary: Closet, lavatories, urinal, bidet etc.

Fitting: Faucet, shower etc.

Kitchen System: Kitchen system, wardrobe, vanity etc.

Accessories: Tissue holder, soap holder, towel hanger etc.

The TOTO Tale: From Japan to Indonesia

SPTO - Surya Pertiwi Tbk.: Founded in 1968, PT. Surya Pertiwi Tbk (SPTO) has been the exclusive agent in Indonesia for TOTO Japan, a leading Japanese manufacturer of bathroom products. TOTO is globally recognized as one of the largest bathroom product manufacturers, with its establishment dating back to 1917. In collaboration with TOTO Japan, SPTO's shareholders set up PT. Surya Toto Indonesia Tbk in 1977 to produce and market TOTO-branded items in Indonesia under TOTO Japan's license. Since 1978, SPTO has been the sole distributor of TOTO products in Indonesia, boasting an extensive distribution network that spans 14 major cities outside Greater Jakarta and Surabaya, covering the entire Indonesian archipelago. In addition to TOTO, SPTO also distributes other prestigious brands such as Villeroy & Boch, Stiebel Eltron, Geberit, Franke, Jacuzzi, and Kaldewei. The company's vision is to offer the most comprehensive selection of bathroom products and top-tier customer service.

Decoding the Numbers: Financial Insights

A closer look at TOTO's financial health and what the metrics reveal.

Price-to-Earnings (P/E) Ratio: 8.45

Analysis: With a P/E of 8.45, TOTO is trading at a discount compared to the industry average of 10.4. This suggests that the market may undervalue TOTO relative to its earnings potential. The forward P/E of 29.15 indicates that the market expects higher earnings growth for TOTO in the future. The company's technological and research edge (moat) could be driving this anticipated growth.

Price-to-Book (P/B) Ratio: 1.03

Definition: The P/B ratio compares a company's market capitalization to its book value. It indicates the inherent value of an asset based on its financials and market value.

Analysis: A P/B ratio close to one suggests that TOTO is trading near its book value. For value-oriented investors, a low P/B ratio can be attractive as it implies that they are paying close to the intrinsic value for the company's assets, providing a margin of safety.

Debt-to-Equity Ratio: 10.53%

Definition: This ratio measures the relative proportion of shareholders' equity and debt used to finance a company's assets.

Analysis: A lower debt-to-equity ratio indicates that TOTO relies less on external debts to finance its operations. This can be seen as a sign of financial stability, as the company is less vulnerable to economic downturns and interest rate hikes.

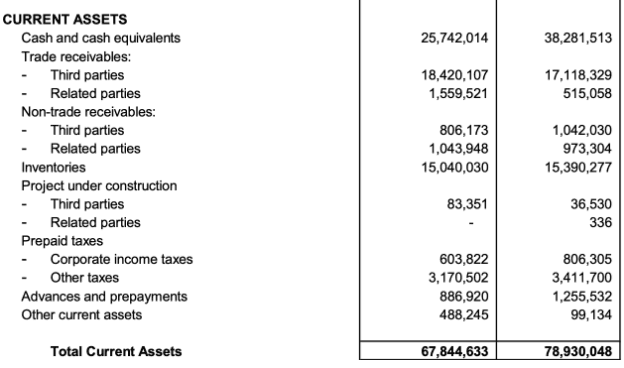

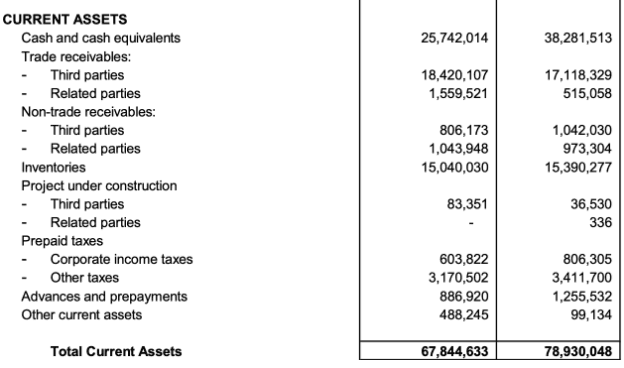

Current Ratio: 3.71

Definition: The current ratio is a liquidity ratio that measures a company's ability to cover its short-term obligations with its short-term assets.

Analysis: With a current ratio significantly higher than the industry average of 1.67, TOTO is in a strong position to meet its short-term liabilities using its short-term assets. This suggests good financial health and lower liquidity risk.

Return on Equity (ROE): 12.76%

Definition: ROE measures the profitability of a company in relation to shareholders' equity. It indicates how well a company is generating earnings from its equity.

Analysis: An ROE of 12.76% suggests that TOTO is effectively using its equity to generate profits. It's a measure of financial performance and indicates the efficiency of equity investment.

Return on Assets (ROA): 6.58%

Definition: ROA measures the profitability of a company in relation to its total assets. It indicates how efficiently a company is using its assets to generate earnings.

Analysis: An ROA of 6.58% indicates that for every dollar of assets, TOTO generates approximately 6.58 cents in profits. This showcases the company's ability to efficiently use its assets to produce profits.

Intrinsic Value Estimation

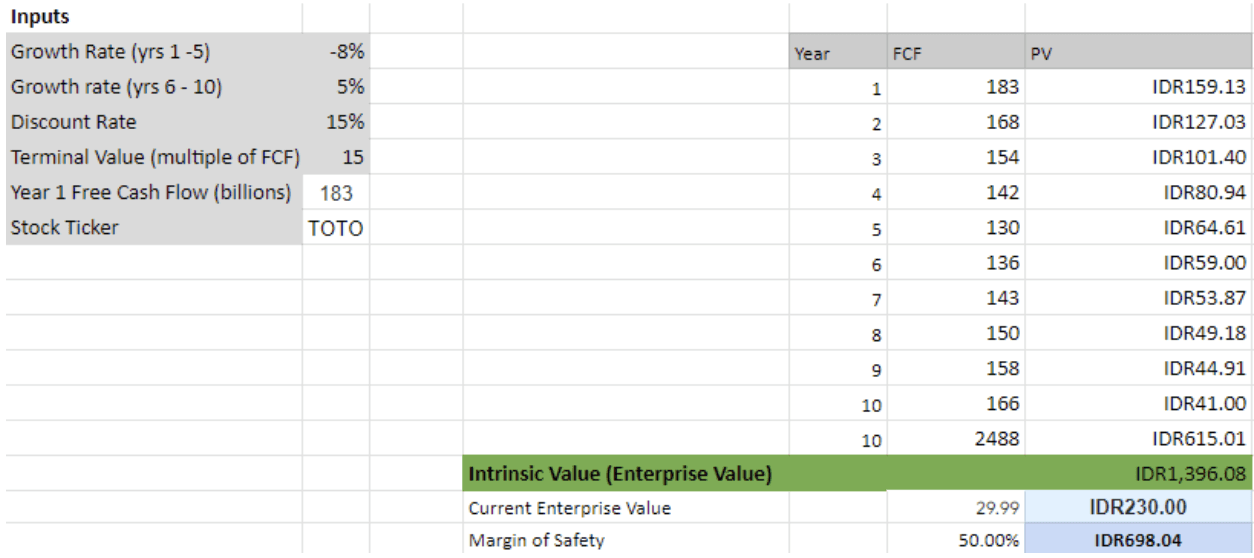

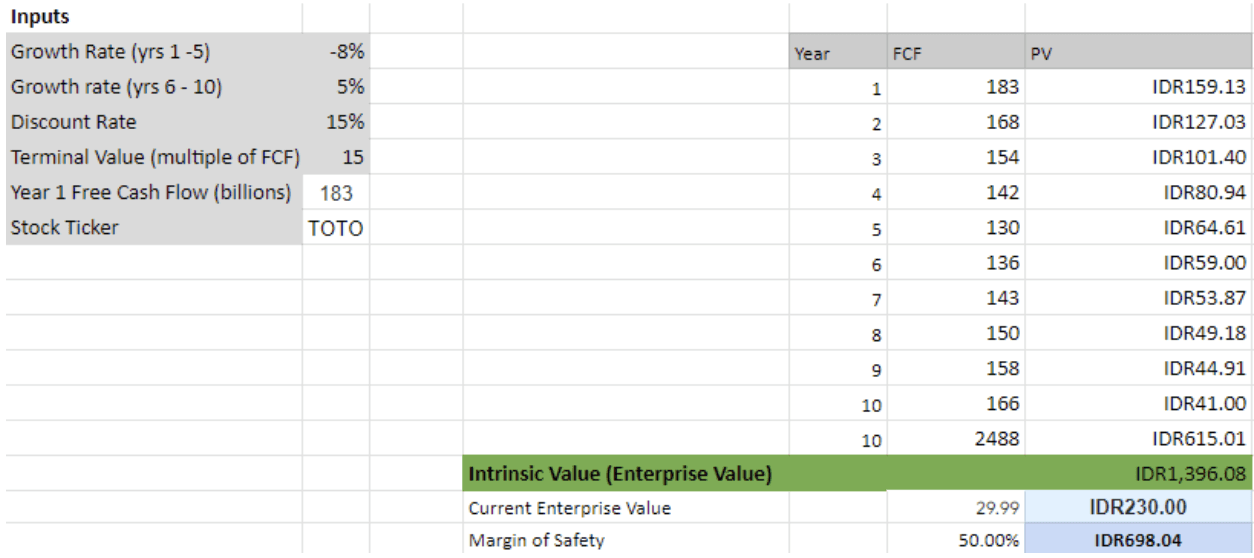

Most Likely Scenario

In this discounted cash flow (DCF) analysis for TOTO, the projections are designed to reflect a balanced, most likely scenario for the company's future trajectory. The growth rates are set at a cautious -8% for the first five years, indicating a period of potential contraction or challenges .Following the initial period, there's an anticipated moderate rebound with a 5% growth rate over the subsequent five years. This positive shift aligns with projections that see Indonesia rising to become the 7th largest economy globally. As a prominent player in the sanitary ware market, TOTO.JK is well-positioned to capitalize on this economic growth and further solidify its market presence (Mckinsey).

With a discount rate of 15%, the present values of the projected free cash flows are calculated for each year. The terminal value, representing the company's value beyond the tenth year, is determined using a multiple of the year 10 free cash flow. Summing up these present values yields an intrinsic enterprise value of IDR1,405.44.

When compared to the current enterprise value of IDR232.00, the analysis reveals a substantial upside potential. Even with a a margin of safety of 50%, the stock still offers significant value upside at its current price. This margin provides a cushion against potential errors in the estimation or unforeseen adverse developments.

Given this analysis, TOTO emerges as a compelling investment opportunity in the most likely scenario, warranting a 'BUY' recommendation. The company's valuation, even under moderate growth assumptions, suggests that it is undervalued and offers potential for significant returns to its shareholders.

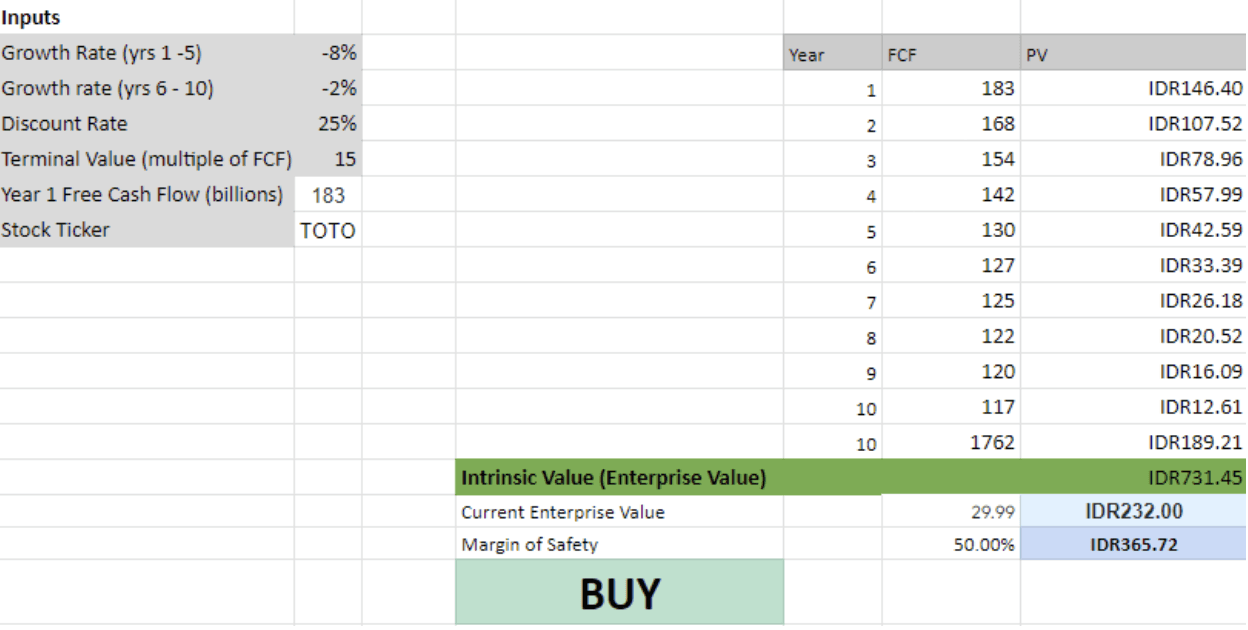

Worst Case Scenario

In the discounted cash flow (DCF) analysis for TOTO, a conservative approach was used. Recognizing the uncertainties inherent in forecasting, the growth rates for the first five years were set at a -8%, followed by a milder negative growth rate of -2% for the subsequent five years. This pessimistic projection serves to model a worst-case scenario for TOTO's future performance. Despite these conservative estimates, the intrinsic value derived from the DCF was significantly higher at 731Rp suggesting a substantial margin of safety. This analysis underscores the robustness of TOTO's valuation, indicating that even under adverse conditions, the company presents a compelling investment opportunity.

Best Case Scenario

In this optimistic discounted cash flow (DCF) analysis for TOTO, the projections reflect a highly favorable outlook for the company's future performance. The growth rates are set at an ambitious 13% taken from their current revenue YOY growth for the initial five years, tapering slightly to a still robust 10% for the subsequent five years. These growth rates capture the potential upside for TOTO, assuming the company capitalizes on favorable market conditions, innovation, and expansion opportunities. With a discount rate of 15% used in the analysis, the intrinsic enterprise value for TOTO.JK is determined to be IDR3,200.59 billion. This represents an upside of 1279% compared to its current enterprise value. TOTO emerges as a highly attractive investment, signaling a strong 'BUY' recommendation based on the company's potential to outperform and deliver exceptional value to its shareholders.

The Competitive Landscape: TOTO's Moat and Risks

What sets TOTO apart? And what challenges lie ahead?

Innovation and Brand Strength: TOTO's edge in the market.

Innovative Products: TOTO Ltd. is renowned for its innovative products, especially the Washlet series, which has gained immense popularity worldwide. The company's commitment to R&D has allowed it to introduce pioneering products in the market.

Global Presence: TOTO has a strong global presence with operations in Asia, Europe, and the Americas. This wide reach allows the company to cater to diverse customer needs and tap into various markets.

Sustainability Initiatives: TOTO is committed to environmental sustainability. The company's products, such as the water-saving toilet, reflect this commitment. TOTO's focus on eco-friendly products gives it an edge in markets where sustainability is a priority.

Quality Assurance: TOTO is known for its high-quality products, which are a result of stringent quality checks and a commitment to excellence. This reputation for quality has helped the company build trust among its customers.

Strong Brand Image: TOTO's brand is synonymous with luxury and sophistication in the sanitary ware industry. The company's consistent branding efforts have solidified its position as a premium brand.

Potential Headwinds: Challenges that could test TOTO's resilience.

Intense Competition: The sanitary ware industry is highly competitive, with several established players. TOTO faces stiff competition from both local and international brands.

Mature Phase: As TOTO is currently in the maturity phase there are potential risks that profitability and growth falls off over time.

Economic Fluctuations: The demand for luxury sanitary ware products can be affected by economic downturns. TOTO, being a premium brand, might face challenges in sales during economic recessions.

Dependence on Specific Markets: While TOTO has a global presence, it might be more dependent on specific markets for a significant portion of its revenue. Any downturn in these markets can impact the company's overall performance.

Supply Chain Disruptions: Global operations mean a complex supply chain. TOTO might face disruptions due to geopolitical issues, natural disasters, or other unforeseen events.

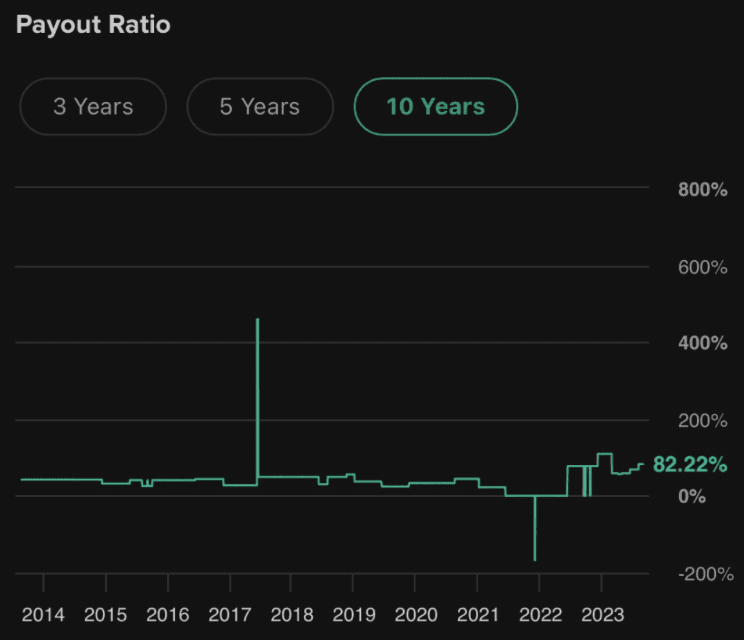

Dividend Deep Dive

Payout Ratio: TOTO's payout ratio stands at 82%. A high payout ratio indicates that the company is returning a significant portion of its earnings back to its shareholders in the form of dividends. This is because TOTO is a mature company who are able to efficiently allocate their capital.

Dividend Streak: With an annual dividend streak of 15 years, TOTO has showcased consistent and reliable dividend payments. This long streak signifies the company's stable financial health, commitment to its shareholders, and its ability to generate consistent profits over the years.

Dividend Yield: The current dividend yield of 8.62% is notably high and one of the reasons I have added it into my portfolio. TOTO also has a continuously growing yield which suggests that the company is confident in its financial performance. This could be due to recovery from the pandemic

The Broader Canvas: Sanitary Ware Market in Indonesia

Price-to-Earnings (P/E) Ratio: 11.89

Price-to-Book (P/B) Ratio: 1.29

Current Ratio: 1.79

Return on Equity (ROE): 8.71%

Return on Assets (ROA): 5.02%

Sanitary Ware Market in Indonesia:

Market Overview: The sanitary ware market in Indonesia has been experiencing growth, driven by factors such as increasing urbanization, rising disposable income, and the growth of the real estate sector (Mordor).

Key Players: Some of the major players in the Indonesian sanitary ware market include TOTO, American Standard, Roca, Kohler, and Duravit.

Product Categories: The market is segmented into various product categories, including washbasins, water closets, cisterns, bathtubs, and others.

Distribution Channels: The products are distributed through multiple channels, such as retail, online, and direct sales.

Trends and Opportunities: The market is expected to witness significant growth opportunities, especially with the increasing demand for luxury sanitary ware products and the adoption of eco-friendly products.

Competitors

IMPC - Impack Pratama Industri Tbk.

Production of building material plastics

Production of PVC products

Production of fiberglass roofing

ARNA - Arwana Citramulia Tbk.

Production of green-certified ceramic tiles

Production of green-certified porcelain tiles

Production of green-certified granite tiles

HEXA - Hexindo Adiperkasa Tbk.

Distribution of heavy equipment and related spare parts

Mini, medium, and large excavators/loading shovels

Wheel loaders, rigid frame trucks, and articulated dump trucks

MLIA - Mulia Industrindo Tbk.

Trading company for products manufactured by its subsidiaries

Production of glass products such as float glass, glass container, glass block, and automotive safety glass

Ensuring products and services meet high standards adhering to various international certifications

AMFG - Asahimas Flat Glass Tbk.

Production of flat glass and automotive glass

Prioritizing safety, comfort, design, and environmental friendliness in their products

Emphasizing an extensive distribution network and long-standing business relations with its customers

MARK - Mark Dynamics Indonesia Tbk.

Manufacturing of hand formers or glove molds

Production of ceramic molds used to produce Nitril and Latex gloves for medical purposes

Production of agricultural products such as chemicals, pesticides, and modern farming equipment

SCCO - Supreme Cable Manufacturing & Commerce Tbk.

Specializing in the cable business for 50 years

One of Indonesia's largest and leading cable manufacturers

Offering international quality and reliability in their products

Epilogue: The Investment Verdict

TOTO Ltd. stands out as a beacon of innovation, financial robustness, and consistent shareholder value creation in the sanitary ware industry. Its strategic ventures, combined with its compelling financial metrics, paint a picture of a company that is not just surviving but thriving. The consistent dividend payouts further sweeten the deal for investors, making TOTO a compelling investment proposition. Given the analysis and the potential upside, myrecommendation is a strong 'BUY' for TOTO.

Company Overview

United Tractors, a subsidiary of PT Astra International Tbk ("Astra"), stands as a testament to Indonesia's industrial prowess. Astra, one of the largest and most established business groups in Indonesia, has a rich history of serving various industries and sectors with unparalleled expeortise. United Tractors has been publicly traded since September 19, 1989, when it listed its shares on the Indonesia Stock Exchange, which was formerly known as the Jakarta Stock Exchange and Surabaya Stock Exchange. Astra currently holds a majority stake in the company, owning 59.5% of its shares, while the rest are held by the public.

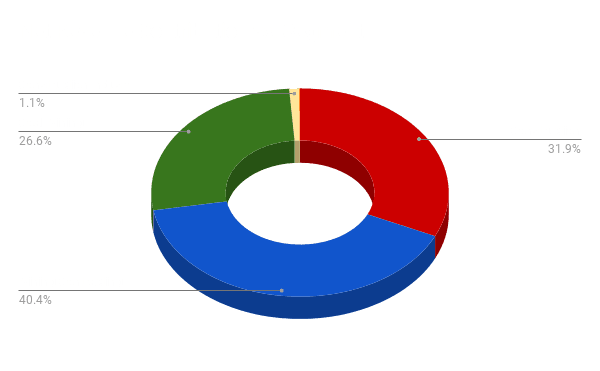

Diving deeper into its operations, United Tractors has strategically positioned itself as a dominant player across multiple sectors in Indonesia. The company's expansive portfolio is organized into six core business pillars:

Construction Machinery: United Tractors offers a range of construction machinery products and services, ensuring that clients have access to top-tier equipment and support for their projects.

Mining Contracting: With expertise in mining operations, the company provides comprehensive mining contracting services, ensuring efficient and sustainable extraction processes.

Coal Mining: United Tractors is actively involved in coal mining, contributing to Indonesia's energy sector and global coal supply.

Gold Mining: The company has also ventured into gold mining, tapping into the lucrative precious metals market.

Construction Industry: Beyond machinery and mining, United Tractors is also engaged in the broader construction industry, offering services and solutions for various infrastructure projects.

Energy: Recognizing the importance of sustainable energy, the company has diversified into the energy sector, aiming to provide cleaner and more efficient energy solutions.

In essence, United Tractors is not just a company; it's an institution that has been instrumental in shaping the industrial landscape of Indonesia. Through its diverse business ventures and unwavering commitment to excellence, the company continues to drive growth and innovation in the region.

Decoding the Numbers: Financial Insights

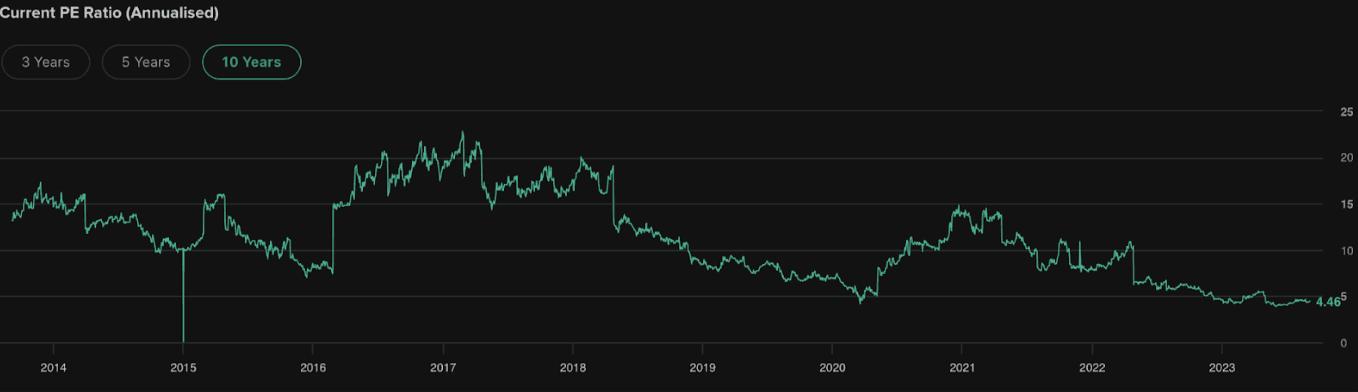

Price-to-Earnings (P/E) Ratio: 4.44

Analysis:

The Price-to-Earnings (P/E) ratio is a valuation metric that measures the price investors are willing to pay for each unit of earnings generated by a company. A P/E ratio of 4.44 for UNTR suggests that investors are currently paying Rp 4.44 for every Rp 1 of earnings the company generates. When compared to its peak P/E ratio of 22.81 in 2017, the current ratio indicates that the company's stock is significantly undervalued. This disparity between the past and present P/E ratios is an attractive proposition for investors, especially when considering that UNTR's operating profit margins are on the rise. While these margins may exhibit cyclical behavior, the overall growth trend in profitability, combined with a low P/E ratio, underscores the potential value proposition of UNTR as an investment.

Price-to-Book (P/B) Ratio: 1.39

Analysis:

Analysis:

The Price-to-Book Value (P/BV) ratio is a critical financial metric that gauges a company's market valuation relative to its book value. For UNTR, the P/BV ratio stands at a notable 1.39. When benchmarked against the sector average of 1.24, this ratio is higher, suggesting that the market values UNTR's net assets at a premium compared to its sector peers.

One significant factor that could justify this higher P/BV ratio is the company's market capitalization. UNTR’s market capitalization is 100,154 B, which is substantially larger than the sector average of 1,856 B.

In this scenario, the vast differential in market cap also implies that UNTR carry lower capital impairment risk. UNTR carry lower perceived risks for several reasons:

Diversification: UNTR has a diversified portfolio of products or services, reducing their reliance on a single revenue source and thereby decreasing business risk.

Financial Flexibility: A higher market capitalization often provides companies with better access to capital markets, allowing them to secure financing at more favorable terms.

Operational Resilience: UNTR can weather economic downturns more effectively due to their resources, established market presence, and ability to adapt to changing market conditions.

This perception of lower risk, combined with the factors mentioned earlier, can lead to a willingness among investors to pay a premium over the company's book value, resulting in a higher P/BV ratio.

Debt-to-Equity Ratio: 0.07

Current Ratio: 1.36

Return on Equity (ROE): 30.44%

Analysis:

Return on Equity (ROE) is a critical financial metric that measures a company's ability to generate profit from its shareholders' equity. An ROE of 30.44% indicates the company's efficiency in using shareholders' funds to produce earnings.

Growing Profitability: An increasing ROE indicates that UNTR’s net income is growing at a faster rate than its equity. Currently, the EPS YoY annual growth rate is 104.34%. This suggests that UNTR is effectively leveraging its resources to increase its earnings.

Competitive Advantage: UNTR's high and increasing ROE suggests a sustainable competitive advantage. Its effective business model and economies of scale make it well-positioned to generate profits. Rising ROE also signals higher returns on investment, making the stock more attractive and potentially leading to positive implications for its valuation and investor confidence.

Overall, it indicates that management is effectively deploying shareholders' capital, and the company is in a strong position to deliver value to its shareholders.

Return on Assets (ROA): 16.26%

Analysis:

Return on Assets (ROA) is a key financial metric that measures a company's ability to generate profit from its total assets. An ROA of 16.26% for UNTR indicates that the company is able to generate a profit of 16.26% for every unit of total assets.

When comparing UNTR's ROA of 16.26% to the sector average of 5.21%, several observations can be made:

Superior Asset Efficiency: UNTR's ROA is significantly higher than the sector average, suggesting that the company is more efficient in using its assets to generate profit than its peers.

Higher Profitability: A higher ROA typically indicates higher profitability. Given that UNTR's ROA is more than three times the sector average, it suggests that the company is not only generating higher profits but is also doing so more efficiently relative to its asset base.

This differential suggests that UNTR is operationally and strategically well-positioned within its sector, making it a standout performer in terms of asset efficiency and profitability.

Intrinsic Value Estimation:

Worst Case Scenario

In evaluating the investment potential of UNTR, even under a pessimistic scenario where we project a declining growth rate due to decreasing coal prices—a significant concern given that coal mining constitutes 29% (as of Q2 2023) of their business operations—the numbers still present a compelling case. The intrinsic value of UNTR, based on the Discounted Cash Flow (DCF) analysis, stands at IDR63,301.15. This is significantly higher than its current enterprise value of IDR26,700.00. This discrepancy provides a substantial margin of safety of >50%, meaning that even if our assumptions and projections are off by half, the stock still offers value at its current price. Furthermore, it's crucial to note that while the coal segment faces challenges, UNTR's construction machinery arm, represented by Komatsu, remains a dominant force in the domestic market. They have consistently outperformed competitors such as Sany, Hitachi, and Caterpillar. This leadership position in a key segment of their business provides a buffer against the challenges faced in the coal sector. Thus, even in a worst-case scenario, UNTR's diversified operations and market leadership in construction machinery make it a worthy investment consideration, especially given the free cash flow and large margin of safety.