Ticker: UNTR.JK

Stock Report 8/31/2023

Purchase Price: Rp 26,715

By: Nathan Wongkar

Disclaimer: This report is for informational purposes only and does not constitute financial advice, endorsement, or recommendation of any investment strategy, security, or product. The author and publisher are not responsible for any investment decisions made based on the information provided in this report. Always consult with a financial advisor before making any investment decisions.

Executive Summary

United Tractors (UNTR.JK), a prominent Indonesian company, has established itself as a leader in the heavy equipment, mining, and energy sectors. Founded in 1972, the company has expanded its operations and diversified its portfolio, making it a significant player in the Indonesian market. This growth trajectory showcases United Tractors' commitment to innovation and its ability to adapt to the ever-evolving demands of the industry.

Company Overview

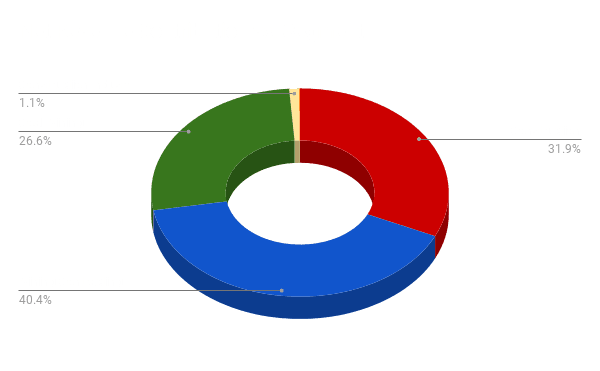

United Tractors, a subsidiary of PT Astra International Tbk ("Astra"), stands as a testament to Indonesia's industrial prowess. Astra, one of the largest and most established business groups in Indonesia, has a rich history of serving various industries and sectors with unparalleled expeortise. United Tractors has been publicly traded since September 19, 1989, when it listed its shares on the Indonesia Stock Exchange, which was formerly known as the Jakarta Stock Exchange and Surabaya Stock Exchange. Astra currently holds a majority stake in the company, owning 59.5% of its shares, while the rest are held by the public.

Diving deeper into its operations, United Tractors has strategically positioned itself as a dominant player across multiple sectors in Indonesia. The company's expansive portfolio is organized into six core business pillars:

Construction Machinery: United Tractors offers a range of construction machinery products and services, ensuring that clients have access to top-tier equipment and support for their projects.

Mining Contracting: With expertise in mining operations, the company provides comprehensive mining contracting services, ensuring efficient and sustainable extraction processes.

Coal Mining: United Tractors is actively involved in coal mining, contributing to Indonesia's energy sector and global coal supply.

Gold Mining: The company has also ventured into gold mining, tapping into the lucrative precious metals market.

Construction Industry: Beyond machinery and mining, United Tractors is also engaged in the broader construction industry, offering services and solutions for various infrastructure projects.

Energy: Recognizing the importance of sustainable energy, the company has diversified into the energy sector, aiming to provide cleaner and more efficient energy solutions.

In essence, United Tractors is not just a company; it's an institution that has been instrumental in shaping the industrial landscape of Indonesia. Through its diverse business ventures and unwavering commitment to excellence, the company continues to drive growth and innovation in the region.

Decoding the Numbers: Financial Insights

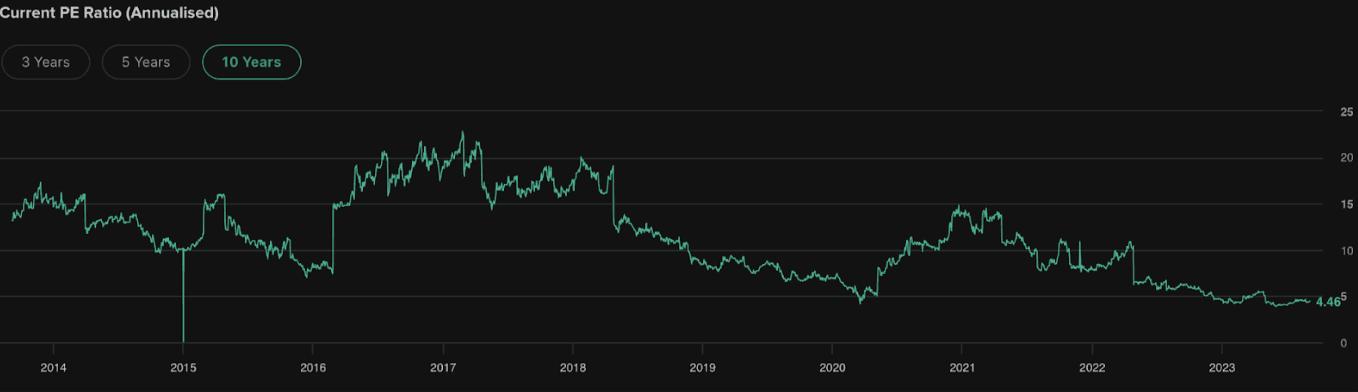

Price-to-Earnings (P/E) Ratio: 4.44

Analysis:

The Price-to-Earnings (P/E) ratio is a valuation metric that measures the price investors are willing to pay for each unit of earnings generated by a company. A P/E ratio of 4.44 for UNTR suggests that investors are currently paying Rp 4.44 for every Rp 1 of earnings the company generates. When compared to its peak P/E ratio of 22.81 in 2017, the current ratio indicates that the company's stock is significantly undervalued. This disparity between the past and present P/E ratios is an attractive proposition for investors, especially when considering that UNTR's operating profit margins are on the rise. While these margins may exhibit cyclical behavior, the overall growth trend in profitability, combined with a low P/E ratio, underscores the potential value proposition of UNTR as an investment.

Price-to-Book (P/B) Ratio: 1.39

Analysis:

Analysis:

The Price-to-Book Value (P/BV) ratio is a critical financial metric that gauges a company's market valuation relative to its book value. For UNTR, the P/BV ratio stands at a notable 1.39. When benchmarked against the sector average of 1.24, this ratio is higher, suggesting that the market values UNTR's net assets at a premium compared to its sector peers.

One significant factor that could justify this higher P/BV ratio is the company's market capitalization. UNTR’s market capitalization is 100,154 B, which is substantially larger than the sector average of 1,856 B.

In this scenario, the vast differential in market cap also implies that UNTR carry lower capital impairment risk. UNTR carry lower perceived risks for several reasons:

Diversification: UNTR has a diversified portfolio of products or services, reducing their reliance on a single revenue source and thereby decreasing business risk.

Financial Flexibility: A higher market capitalization often provides companies with better access to capital markets, allowing them to secure financing at more favorable terms.

Operational Resilience: UNTR can weather economic downturns more effectively due to their resources, established market presence, and ability to adapt to changing market conditions.

This perception of lower risk, combined with the factors mentioned earlier, can lead to a willingness among investors to pay a premium over the company's book value, resulting in a higher P/BV ratio.

Debt-to-Equity Ratio: 0.07

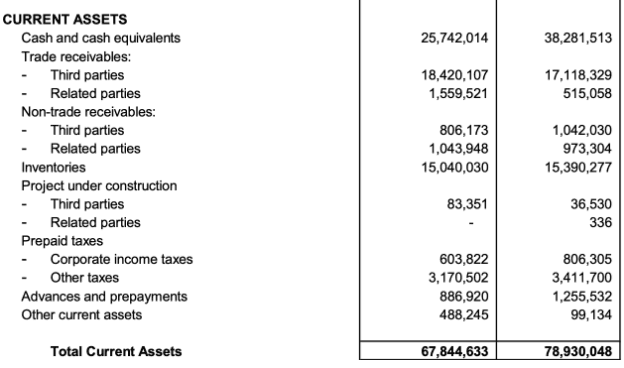

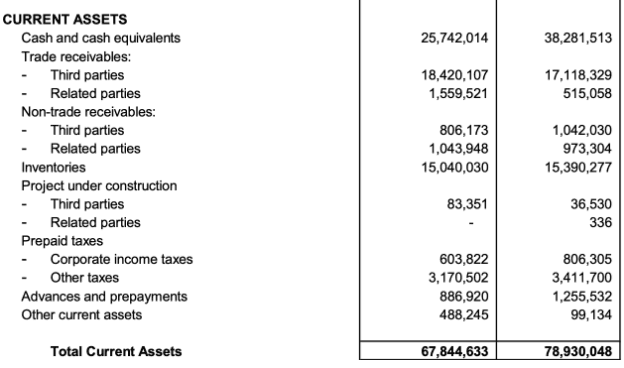

Current Ratio: 1.36

Return on Equity (ROE): 30.44%

Analysis:

Return on Equity (ROE) is a critical financial metric that measures a company's ability to generate profit from its shareholders' equity. An ROE of 30.44% indicates the company's efficiency in using shareholders' funds to produce earnings.

Growing Profitability: An increasing ROE indicates that UNTR’s net income is growing at a faster rate than its equity. Currently, the EPS YoY annual growth rate is 104.34%. This suggests that UNTR is effectively leveraging its resources to increase its earnings.

Competitive Advantage: UNTR's high and increasing ROE suggests a sustainable competitive advantage. Its effective business model and economies of scale make it well-positioned to generate profits. Rising ROE also signals higher returns on investment, making the stock more attractive and potentially leading to positive implications for its valuation and investor confidence.

Overall, it indicates that management is effectively deploying shareholders' capital, and the company is in a strong position to deliver value to its shareholders.

Return on Assets (ROA): 16.26%

Analysis:

Return on Assets (ROA) is a key financial metric that measures a company's ability to generate profit from its total assets. An ROA of 16.26% for UNTR indicates that the company is able to generate a profit of 16.26% for every unit of total assets.

When comparing UNTR's ROA of 16.26% to the sector average of 5.21%, several observations can be made:

Superior Asset Efficiency: UNTR's ROA is significantly higher than the sector average, suggesting that the company is more efficient in using its assets to generate profit than its peers.

Higher Profitability: A higher ROA typically indicates higher profitability. Given that UNTR's ROA is more than three times the sector average, it suggests that the company is not only generating higher profits but is also doing so more efficiently relative to its asset base.

This differential suggests that UNTR is operationally and strategically well-positioned within its sector, making it a standout performer in terms of asset efficiency and profitability.

Intrinsic Value Estimation:

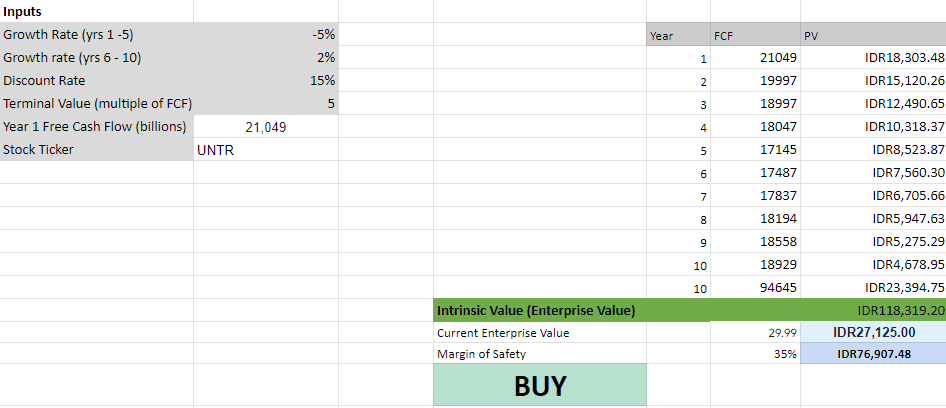

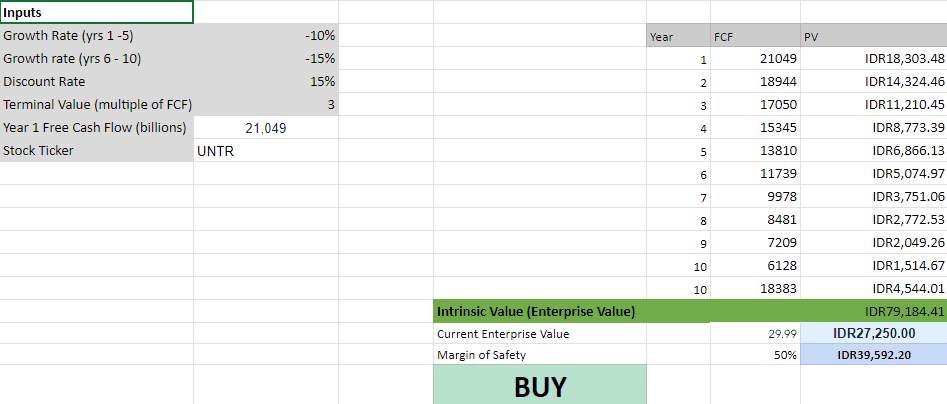

Worst Case Scenario

In evaluating the investment potential of UNTR, even under a pessimistic scenario where we project a declining growth rate due to decreasing coal prices—a significant concern given that coal mining constitutes 29% (as of Q2 2023) of their business operations—the numbers still present a compelling case. The intrinsic value of UNTR, based on the Discounted Cash Flow (DCF) analysis, stands at IDR63,301.15. This is significantly higher than its current enterprise value of IDR26,700.00. This discrepancy provides a substantial margin of safety of >50%, meaning that even if our assumptions and projections are off by half, the stock still offers value at its current price. Furthermore, it's crucial to note that while the coal segment faces challenges, UNTR's construction machinery arm, represented by Komatsu, remains a dominant force in the domestic market. They have consistently outperformed competitors such as Sany, Hitachi, and Caterpillar. This leadership position in a key segment of their business provides a buffer against the challenges faced in the coal sector. Thus, even in a worst-case scenario, UNTR's diversified operations and market leadership in construction machinery make it a worthy investment consideration, especially given the free cash flow and large margin of safety.

Most Likely Scenario

Given the recent windfall profits from coal, it's anticipated that UNTR's growth rate will decelerate, especially in the mining contracting and coal mining segments. This is largely due to the cyclical nature of the coal industry and the potential for a slowdown in demand. However, this anticipated slowdown might not be as pronounced as initially thought. The company's Q2 2023 reports indicate continued 22% growth in the mining contracting and 8% growth in coal mining, even in the face of declining coal prices. This suggests a robustness in UNTR's operations and perhaps a diversification of revenue streams that insulate it from the full impact of coal price fluctuations.

For our valuation, we've taken a conservative approach. We project that the company will trade at a P/E of 5, slightly higher than its current level of 4.44 and a projected forward P/E of 6. This is to account for potential market uncertainties and to provide a buffer in our estimates. Over a 10-year horizon, we anticipate the company to grow at a modest rate of 2%. This growth rate, while conservative, acknowledges the company's demonstrated resilience and potential for expansion in other areas.

One of the standout features in UNTR's financials is its significant cash reserves. This not only provides the company with a cushion to weather potential downturns but also offers strategic flexibility in terms of potential acquisitions or investments. When factoring in this cash position, our valuation provides a margin of safety of over 50%. This means that even if some of our assumptions don't pan out as expected, an investment in UNTR at the current price still offers a significant buffer against potential downside risks.

In conclusion, while there are industry headwinds and potential challenges ahead, UNTR's financial strength, demonstrated resilience, and our conservative valuation approach make it an attractive investment proposition.

source: tradingeconomics.com

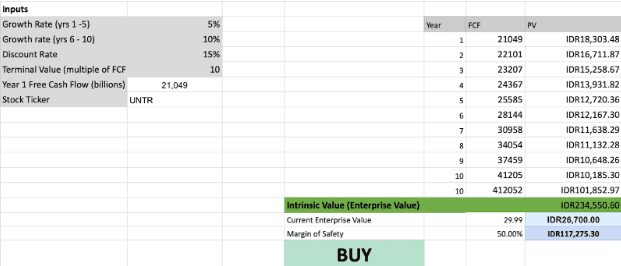

Best Case Scenario

In the best-case scenario for UNTR, the projected growth rates are 5% for the first 5 years and 10% for the subsequent 5 years. These optimistic rates result in an intrinsic value of IDR234,550.60, substantially higher than the current enterprise value of IDR26,700.00. This provides a significant margin of safety for investors.

The Competitive Landscape:

SWOT Analysis:

Strengths:

Diverse Business Operations: United Tractors' business activities encompass the distribution of construction machinery, mining contracting, and mining.

Significant Mining Reserves: The company holds ownership of several coal mining concessions with an estimated total reserve of 400 million tons.

Exclusive Distributorship: United Tractors is the sole distributor for products from renowned brands such as Komatsu, UD Trucks, Scania, Bomag, Tadano, and Komatsu Forest.

Certifications: The company has acquired various national and international certifications, showcasing its commitment to quality and standards.

Weaknesses:

Limited Technical Staff: There's a shortage of technical personnel for construction machinery.

Limited Branches: The number of branch offices and support offices is relatively low.

Dependency on Suppliers: The company's reliance on agreements with suppliers can be a potential vulnerability.

Insufficient Heavy Equipment: There's a lack of heavy machinery and supporting equipment for mining operations.

Opportunities:

High Market Demand: There's a significant market demand for the products and services offered by the company.

Technological Advancements: Rapid advancements in construction machinery technology present opportunities for growth and innovation.

Threats:

Increasing Competition: The rise in competitors targeting the same market segment.

Mining Safety Risks: Mining operations inherently carry high safety risks.

Unstable Mining Outputs: The availability of mining yields is not consistent.

In conclusion, while United Tractors has several strengths and opportunities, it also faces certain challenges and threats in the market. The company needs to leverage its strengths, address its weaknesses, capitalize on opportunities, and mitigate threats to ensure sustained growth and competitiveness.

Dividend Deep Dive

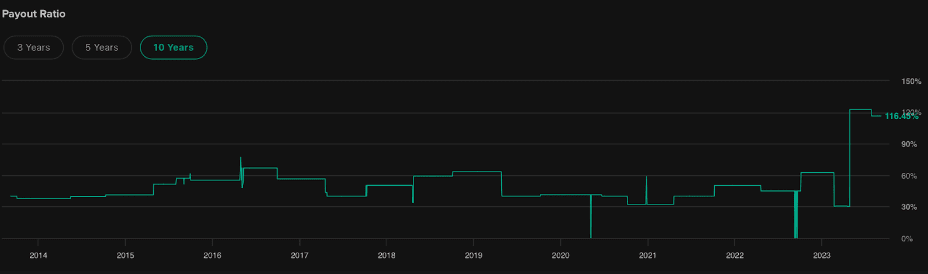

Payout Ratio:

Dividend Yield:

The dividend payout ratio is a key metric that indicates the proportion of earnings a company pays to its shareholders in the form of dividends. UNTR's current dividend payout ratio of 116% is exceptionally high, suggesting that the company is distributing more than its net income as dividends. This can be attributed to the surge in coal prices and the subsequent increase in coal exports, leading to a significant windfall in dividends. Such a scenario is not uncommon for companies in commodity-driven sectors, where windfalls can lead to generous dividend distributions.

However, even when we look at UNTR's historical average payout ratio, which ranges between 40% and 60%, it is still considerably higher than the industry average of 30%. This indicates a consistent strategy by UNTR to reward its shareholders with a larger portion of its earnings compared to its peers.

The dividend yield, which represents the annual dividend payment as a percentage of the stock's current market price, further accentuates this point. UNTR's impressive yield of 25.54% is significantly higher than the industry standard of 1.9%. Such a high yield can be a strong attraction for income-focused investors, as it suggests a substantial return on investment through dividends alone.

The Broader Canvas

Price-to-Earnings (P/E) Ratio: 9.07

Price-to-Book (P/B) Ratio: 1.24

Current Ratio: 1.59

Return on Equity (ROE): 10.27%

Return on Assets (ROA): 4.83%

Indonesian Mining Contracting Sector:

Market Overview: Indonesia is a significant player in the global mining industry, with substantial reserves of various minerals. The sector has been a cornerstone of Indonesia's economic growth, with nickel being a significant contributor.

Key Players: Major mining companies in Indonesia include Freeport-McMoRan, Vale Indonesia, and Antam.

Trends and Opportunities: The Indonesia Morowali Industrial Park (IMIP) is an integrated nickel hub for steel production, with a supply chain for battery production planned. The country is also developing the Indonesia Weda Bay Industrial Park (IWIP) on Halmahera Island. Given that Indonesia is the world's largest nickel producer, any policy changes or physical events in the country could significantly impact global nickel supply chains.

Indonesian Coal Mining Sector:

Market Overview: Indonesia is one of the world's top coal producers and exporters. The rise in coal prices has significantly benefited Indonesian coal miners.

Key Players: Major coal producers include Adaro Energy, Bumi Resources, and Bukit Asam.

Trends and Opportunities: With the global demand for energy, especially from emerging economies, Indonesian coal is expected to see steady demand. However, environmental concerns and the global shift towards renewable energy sources might pose challenges in the long run.

Indonesian Gold Mining Sector:

Market Overview: Indonesia houses some of the world's largest gold mines. The sector contributes significantly to the country's export revenue.

Key Players: Notable players include Freeport-McMoRan (which operates the Grasberg mine) and Archi Indonesia.

Trends and Opportunities: With gold being a safe-haven asset, its demand tends to remain steady. Indonesia's rich reserves provide an opportunity for increased exploration and production.

Indonesian Construction Industry:

Market Overview: The construction sector in Indonesia has seen growth, driven by urbanization and infrastructure development projects. As of 2021, the value of civil construction completed in Indonesia was approximately 808.7 trillion Indonesian rupiah.

Key Players: Major construction companies include Wijaya Karya (WIKA), Adhi Karya, and Waskita Karya.

Trends and Opportunities: The government's focus on infrastructure development, coupled with private sector investments, is expected to drive growth in this sector.

Indonesian Energy Sector:

Market Overview: Indonesia is rich in energy resources, including oil, natural gas, and renewable sources like geothermal energy.

Key Players: Pertamina is the state-owned enterprise responsible for oil and gas production.

Trends and Opportunities: With the global shift towards cleaner energy sources, Indonesia's vast geothermal potential provides a significant opportunity for growth.

Incorporating these insights with the provided data on the sanitary hardware industry, it's evident that Indonesia's diverse sectors offer a plethora of opportunities for investors and businesses. The country's rich natural resources, coupled with its strategic location and growing economy, make it a hotspot for various industries.

Mining:

Company Name: PT Adaro Energy Tbk

Brief Overview of Operations: PT Adaro Energy Tbk is one of the largest coal mining companies in Indonesia. They focus on integrated coal mining through subsidiaries, including exploration, mining, and processing of coal.

PT Freeport Indonesia

Engaged in the mining, processing, and exploration of ore containing copper, gold, and silver.

PT Bukit Asam (Persero) Tbk.

State-owned company engaged in coal mining.

PT Vale Indonesia Tbk.

Engaged in mining, processing, and exploration for nickel.

PT Kaltim Prima Coal

Engaged in the mining and sale of coal for domestic and international customers.

PT Antam (Persero) Tbk.

Diversified mining and metals company with operations spread throughout the mineral-rich Indonesian archipelago.

PT Bumi Resources Tbk.

Engaged in coal mining and oil exploration based on its concession coal mines.